A Call to Expand the Child Tax Credit to Reach More Hispanic Families

End Notes

[1] This report uses the term “Hispanic” to refer to people of any race who identify as being of Hispanic, Latino, or Spanish origin, consistent with U.S. Census Bureau usage. This language does not necessarily reflect how everyone that is part of this community would describe themselves. For example, gender-inclusive terms like Latinx and Latine can also be used to refer to this population. These terms have emerged in recent years to represent the diversity of gender identities and expressions that are present in the community.

[2] Cary Funk and Mark Hugo Lopez, “A Brief Statistical Portrait of U.S. Hispanics,” Pew Research Center, June 14, 2022, https://www.pewresearch.org/science/2022/06/14/a-brief-statistical-portrait-of-u-s-hispanics/.

[3] Jeffrey S. Passel and D’Vera Cohn, “U.S. Unauthorized Immigrant Total Dips to Lowest Level in a Decade,” Pew Research Center, November 27, 2018, https://www.pewresearch.org/hispanic/2018/11/27/u-s-unauthorized-immigrant-total-dips-to-lowest-level-in-a-decade/.

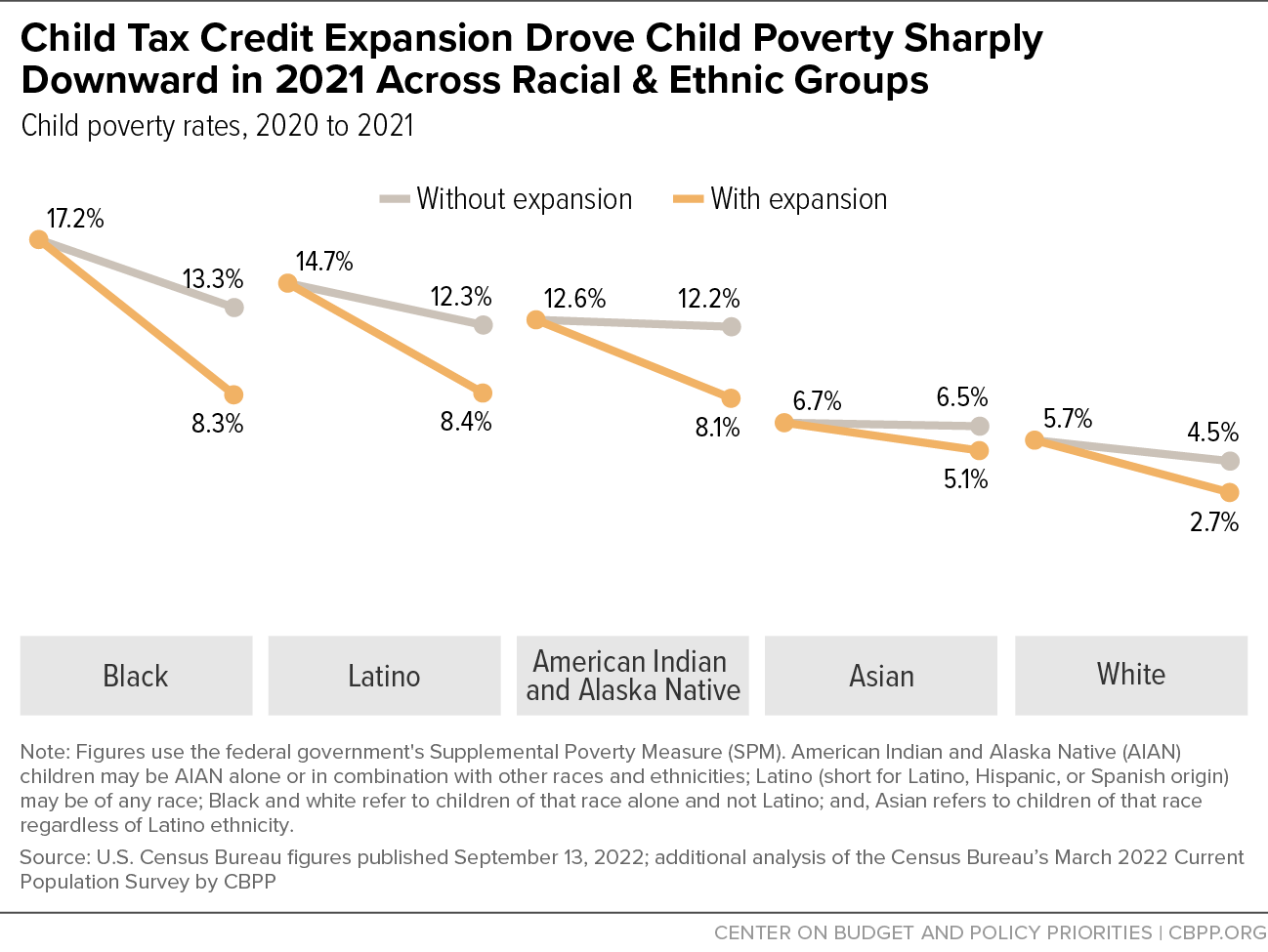

[4] Kaylee Burns, Liana Fox, and Danielle Wilson, “Expansions to Child Tax Credit Contributed to 46% Decline in Child Poverty Since 2020,” U.S. Census Bureau, September 13, 2022, https://www.census.gov/library/stories/2022/09/record-drop-in-child-poverty.html.

[5] Chuck Marr, Kris Cox, and Arloc Sherman, “Recovery Package Should Permanently Include Families With Low Incomes in Full Child Tax Credit,” CBPP, September 7, 2021, https://www.cbpp.org/research/federal-tax/recovery-package-should-permanently-include-families-with-low-incomes-in-full.

[6] Estimate is based on the 2018 economy using the U.S. Census Bureau’s March 2019 Current Population Survey, with incomes inflated to 2022 and applying 2022 tax parameters. The 2018 data are the most recent reliable data that are likely to resemble 2022 in terms of employment and other benefits and to be free of major data collection problems associated with surveys gathered during the pandemic. Due to limitations of the Census data, the figures do not reflect IRS rules that require children to have a Social Security number to qualify for the Child Tax Credit.

[7] CBPP analysis of the Census Bureau’s March 2022 Current Population Survey; UnidosUS, “Hispanic Children and the Child Tax Credit,” June 2021, https://www.unidosus.org/wp-content/uploads/2021/08/unidosus_hispanicchildrenandctc.pdf.

[8] Chuck Marr et al., “Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent,” CBPP, May 24, 2021, https://www.cbpp.org/research/federal-tax/congress-should-adopt-american-families-plans-permanent-expansions-of-child.