off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Ryan Roundup: What You Need to Know About Chairman Ryan’s Poverty Proposal

| By

CBPP

We’ve compiled CBPP’s analyses and blog posts on House Budget Committee Chairman Paul Ryan’s new poverty proposal. We’ll update this roundup as we issue additional analyses.

- Blog Post: Why the Ryan Plan Should Worry Those Concerned About the Affordable Housing Crisis, Part 2

August 5, 2014

House Budget Committee Chairman Paul Ryan’s proposal to consolidate 11 safety net and related programs, including the four largest federal rental assistance programs, into a single block grant to states risks significant funding cuts to housing assistance that helps 4.7 million low-income families. The combination of those cuts, and the possible elimination under Ryan’s plan of program rules that ensure housing stability and affordable rents, could undercut rental assistance programs’ effectiveness and put substantial numbers of vulnerable families at risk for homelessness. - Blog Post: Why the Ryan Plan Should Worry Those Who Are Concerned About the Affordable Housing Crisis, Part 1

July 31, 2014

A centerpiece of House Budget Committee Chairman Paul Ryan’s poverty plan is the proposal to consolidate 11 safety net programs — including four housing assistance programs — into a single, flexible block grant to states. Among its downsides, this proposal threatens to lead to reductions in funding that provides housing assistance to millions of low-income families and individuals. - Blog Post: What Difference Would Ryan’s EITC Expansion Make for Childless Workers?

July 29, 2014

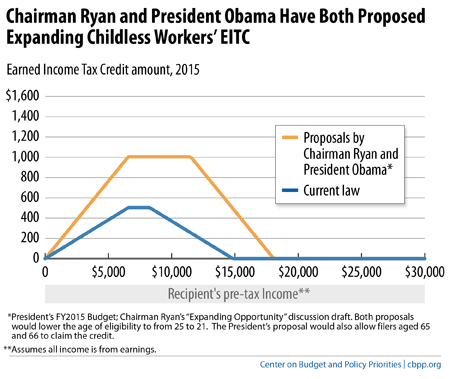

We’ve explained that House Budget Committee Chairman Paul Ryan’s proposed expansion of the Earned Income Tax Credit (EITC) for childless adults, including non-custodial parents, would encourage work and reduce poverty. Our interactive chart allows you to compare the EITC that childless workers at different income levels would earn under current law and under the Ryan expansion, which mirrors a proposal from President Obama. - Blog Post: Ryan’s “Opportunity Grant” Would Likely Force Cuts in Food and Housing Assistance

July 29, 2014

House Budget Committee Chairman Paul Ryan maintains that consolidating 11 safety-net and related programs into a single “Opportunity Grant” would give states the flexibility to provide specialized services to low-income people. But providing these additional services would require cutting assistance funded through the Opportunity Grant to other needy people. And because SNAP (formerly food stamps) and housing assistance together make up more than 80 percent of the Opportunity Grant, the cuts would almost certainly reduce families’ access to these programs, which are effective at reducing poverty — particularly deep poverty. - Blog Post: History Suggests Ryan Block Grant Would Be Susceptible to Cuts

July 28, 2014

Ryan says that the block grant would maintain the same overall funding as the current programs. But even if one thought that current-law funding levels were adequate, they likely wouldn’t be sustained over time under the Ryan proposal: history shows that block grants that consolidate a number of programs or may be used for a wide array of purposes typically shrink — often very substantially — over time. - Blog Post: Why Ryan’s Proposed Work Requirements Are Cause for Concern

July 25, 2014

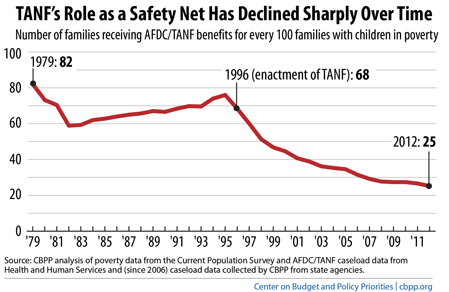

House Budget Committee Chairman Paul Ryan’s new poverty plan predictably showcases the 1996 welfare law, which replaced Aid to Families with Dependent Children (AFDC) with Temporary Assistance for Needy Families (TANF), as a model for reforming other safety net programs. For example, states would have to impose work requirements on all recipients of assistance funded through the “Opportunity Grant” — the block grant that would replace 11 safety net and related programs — who are not classified as unable to work. We have four key concerns about this proposal. - Blog Post: Dean: SNAP Is a Successful, Influential Component of the Safety Net

July 25, 2014

SNAP is not only one of the most efficient and effective safety net programs, but it’s also helping improve other programs, CBPP’s Stacy Dean told a House Agriculture subcommittee. - Commentary: Ryan “Opportunity Grant” Proposal Would Likely Increase Poverty and Shrink Resources for Poverty Programs Over Time

July 24, 2014

A centerpiece of House Budget Committee Chairman Paul Ryan’s new poverty plan would consolidate 11 safety-net and related programs — from food stamps to housing vouchers, child care, and the Community Development Block Grant (CDBG) — into a single block grant to states. This new “Opportunity Grant” would operate initially in an unspecified number of states. While some other elements of the Ryan poverty plan deserve serious consideration, such as those relating to the Earned Income Tax Credit and criminal justice reform, his “Opportunity Grant” would likely increase poverty and hardship, and is therefore ill-advised, for several reasons. - Blog Post: Ryan Adds Momentum to Expanding EITC for Childless Workers

July 24, 2014

House Budget Committee Chairman Paul Ryan highlighted the Earned Income Tax Credit as one of the most effective anti-poverty programs and joined growing bipartisan calls to expand it for childless adults (including non-custodial parents), the lone group that the federal tax system taxes into poverty. We applaud this step, though we encourage him to reconsider some of his proposals to offset the cost — which would hit vulnerable families — and his opposition to a much-needed increase in the minimum wage.Image

- Blog Post: Ryan’s Rhetoric Doesn’t Match His Proposal’s Reality

July 24, 2014

House Budget Committee Chairman Paul Ryan left the impression that his proposed Opportunity Grant will allow low-income individuals to get income assistance as well as help they may need to go to school, get off drugs, and succeed in the workplace. That picture, however, doesn’t reflect the reality of his proposal.

We also issued several pieces ahead of Chairman Ryan’s announcement of his proposal:

- Analysis: Deep Poverty Among Children Worsened in Welfare Law’s First Decade

July 23, 2014

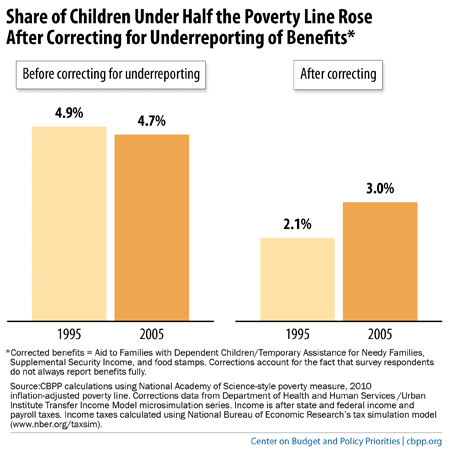

Since the mid-1990s, when policymakers made major changes in the public assistance system, the proportion of children living in poverty has declined, but the harshest extremes of child poverty have increased. After correcting for the well-known underreporting of safety net benefits in the Census data, we estimate that the share of children in deep poverty — with family income below half of the poverty line — rose from 2.1 percent to 3.0 percent between 1995 and 2005. The number of children in deep poverty climbed from 1.5 million to 2.2 million.Blog Post: Fewer Poor Children Under Welfare Law, But More Very Poor ChildrenImage - Blog Post: CLASP: State Experiences Show Safety Net Programs Don’t Need Massive Overhaul to Work Better

July 23, 2014

Olivia Golden of the Center for Law and Social Policy (CLASP) took a closer look at the experiences of six states to debunk common myths about the delivery of safety net programs. . . . Golden explained that the experiences of the six states involved in the Work Support Strategies (WSS) initiative — a project coordinated by CBPP, CLASP, and the Urban Institute that is designing, testing, and implementing more effective, streamlined, and integrated approaches to delivering key supports for low-income working families — offer lessons for how to improve safety net programs. - Blog Post: Why the 1996 Welfare Law Is Not a Model for Other Safety Net Programs

July 22, 2014

House Budget Committee Chairman Paul Ryan’s upcoming poverty plan will likely showcase the 1996 welfare law, which replaced Aid to Families with Dependent Children (AFDC) with Temporary Assistance for Needy Families (TANF) — a block grant with fixed federal funding but broad state flexibility — as a model for reforming other safety net programs. A careful examination of the record, however, indicates that the 1996 law’s results were mixed and that if the goal is to reduce poverty, especially among the most disadvantaged families and children, there are serious downsides to embracing the 1996 law as a model.Image

- Commentary: Policymakers Often Overstate Marginal Tax Rates — and Understate Trade-Offs In Reducing Them

July 22, 2014

Some Washington policymakers are increasingly focused on whether government benefits for low- and moderate-income people create disincentives to work — in particular, when these benefits phase down as the earnings of beneficiaries rise.That phase-down rate is often called the “marginal tax rate” because it resembles a tax — benefits fall as earnings rise. The relationship between marginal tax rates and disincentives to work is an important issue, one worthy of serious debate. Some policymakers, however, often overstate the size of marginal tax rates and their impacts on work, and understate the trade-offs in trying to lower these rates.Blog Post: Understanding Marginal Tax Rates and Government Benefits

Stay up to date

Receive the latest news and reports from the Center