off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

History Suggests Ryan Block Grant Would Be Susceptible to Cuts

Receive the latest news and reports from the Center

At the heart of House Budget Committee Chairman Paul Ryan’s new poverty plan is a block grant — called the “Opportunity Grant” — that would consolidate 11 disparate low-income programs, the largest being SNAP (formerly food stamps). Ryan says that the block grant would maintain the same overall funding as the current programs. But even if one thought that current-law funding levels were adequate, they likely wouldn’t be sustained over time under the Ryan proposal: history shows that block grants that consolidate a number of programs or may be used for a wide array of purposes typically shrink — often very substantially — over time.

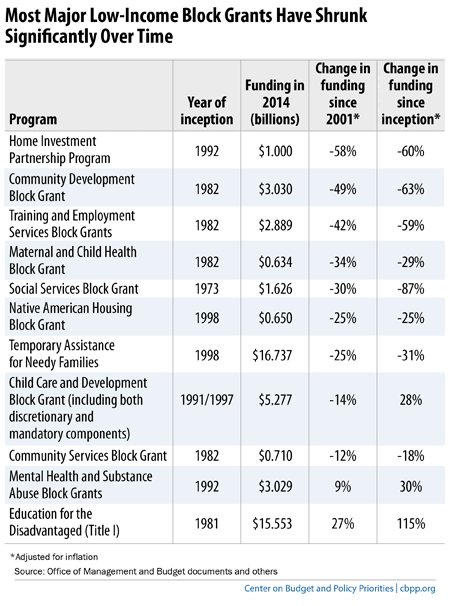

The table below shows 11 major block grant programs created in recent decades. Eight of them have shrunk since their inception, in some cases sharply. (Our analysis accounts for the effect of inflation.)

Block grants’ very structure makes them vulnerable to cuts. Block grants generally give state and local governments more flexibility in how to use funds, leading to varied approaches for achieving program goals. But this variety makes it hard to see how changes in funding levels affect beneficiaries, or even to be sure how the money is being used. That, in turn, makes it easier for policymakers looking for savings to target block grants rather than other benefit programs for long-term freezes or cuts. Block grants in general have fared poorly in the competition for resources.