BEYOND THE NUMBERS

Policymakers Should Focus on the True Cost of an Item on Corporate Lobby’s Tax Break Wish List

November 30, 2023: This post has been updated.

Corporate lobbyists are “pleading for extension of three key tax breaks” in a year-end tax package, Bloomberg reports — a tax package that Democrats insist must include an expansion of the Child Tax Credit. The three corporate tax breaks on lobbyists’ wish list: immediate expensing of research and experimentation costs (R&E), more generous deductions for interest expenses, and full expensing of capital investment costs. Each of these corporate provisions has issues, but full expensing in particular sticks out as highly problematic because its true revenue cost is masked by timing gimmicks.

Full expensing allows businesses to reduce their tax liabilities by deducting the full cost of capital investments immediately rather than over a set number of years. (The underlying depreciation rules generally provide for accelerated deductions compared to the useful life of assets.) Before the 2017 tax law, temporary “bonus” depreciation rules allowed companies to deduct 50 percent of the value of these investments in the first year. The 2017 tax law temporarily allowed full expensing through 2022, then phased this benefit down to a “bonus” depreciation schedule through 2026.

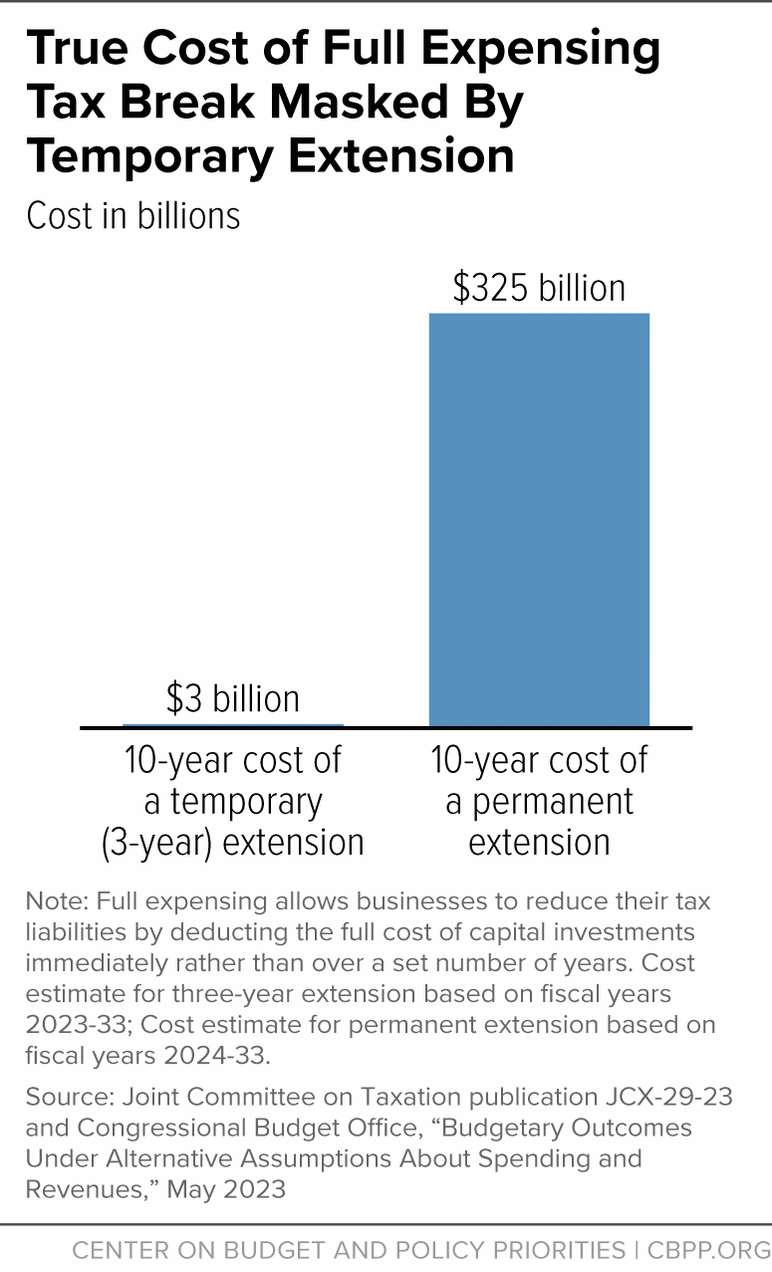

The House Ways and Means Committee approved a bill in June that would implement the three tax breaks through 2025, which the Joint Committee on Taxation (JCT) estimates would cost $47 billion over ten years. If one looks at this JCT score of the House bill, the cost of full expensing is easy to miss at just $3 billion over ten years. That’s because the House legislation relies on a classic timing gimmick to mask the provision’s full cost.

Here’s how it works: the official cost analysis of this temporary tax break shows the revenue losses while it’s in effect through 2025, but then shows revenue increasing (above current law levels) in the years after it is technically scheduled to expire. The net effect of the temporary measure over ten years masks the true ten-year costs that would occur if the provision was made permanent.

Given the corporate lobby’s obvious wish to make this tax break permanent, policymakers need to see through the timing gimmick to focus on its permanent cost. In general, if Congress enacts a three-year tax provision that costs $3 billion over ten years, then absent timing gimmicks, one would expect the same provision enacted on a permanent basis to cost $10-$12 billion over ten years.

In this case, the ten-year cost of enacting full expensing for three years is $3 billion. But making full expensing permanent would actually cost $325 billion over ten years, or 100 times more than enacting the provision temporarily, the Congressional Budget Office reported, relying on a separate JCT analysis. (See chart.) The difference is driven by a timing gimmick that masks the cost of full expensing.

The R&E provision has a similar timing issue. The permanent cost is proportionally larger than its temporary cost but to a lesser degree than the full expensing provision. The interest deductibility provision has serious substantive flaws as an unneeded additional tax break for highly leveraged companies, such as many private-equity-owned businesses, but its cost is more straightforward.

Overall, profitable corporations received substantial tax breaks under the 2017 tax law due to the cut in the corporate tax rate from 35 percent to 21 percent. The 2017 law also changed the tax treatment of R&E expenses, capital investments, and interest costs to partially offset the cost of the corporate tax cut. When the 2017 law was passed, proponents used these provisions to claim $292 billion in “savings” in the last five years of the budget window to “pay for” 40 percent of the corporate tax rate cut in those years, according to JCT estimates. Now, Republicans want to claw back those changes — without a corresponding increase in the corporate tax rate.

Moreover, current law already provides generous depreciation treatment for investments in plant and equipment. Companies will receive an 80 percent bonus this year and a 60 percent bonus in 2024 on top of the underlying accelerated depreciation rules.

Given full expensing’s large cost, its generous tax treatment in current law, and its close connection to the setting of the corporate tax rate, policy deliberations around the provision and alternative approaches would be better suited for the broader tax debate anticipated in 2025, when the individual provisions of the 2017 tax law expire, than in a tax package at the end of this year.

The top priority for any year-end tax bill should be expanding the Child Tax Credit to reduce child poverty, as we’ve explained. Current tax treatment of capital investments is already generous, and the grossly understated cost of a temporary full expensing provision risks a huge corporate giveaway that could swamp the investment made in children through a Child Tax Credit expansion.