The new House Ways and Means Committee Republican tax package prioritizes corporate shareholders and leaves children behind.[1] Most fundamentally, it excludes what should be this year’s top tax policy priority: ensuring the 19 million children who now receive a partial Child Tax Credit or none at all because their families’ incomes are too low receive the same credit as children in higher-income families. Instead, the bill prioritizes giving new windfall tax benefits to wealthy corporate shareholders. Policymakers should reject this bill and pursue tax policy that works better for the country as a whole — not just wealthy investors and high-income households.

The House Republican tax package gives more breaks to shareholders by rolling back revenue raisers that were used in the 2017 tax law to offset part of that law’s very costly corporate tax rate cut, without reversing any of that tax rate cut. Two particularly egregious provisions would provide retroactive tax breaks for corporate investments and business decisions that have already been made, which cannot stimulate new activity or investment but would give large new benefits to corporations and their shareholders. By making the corporate tax cuts temporary, the House tax bill masks their true cost.

Compounding these poor choices, to offset the cost of these flawed corporate tax policies the legislation would set back efforts to address climate change by repealing green energy tax credits included in the Inflation Reduction Act.

And once again, House Republicans have proposed making it harder for the IRS to collect taxes that are legally owed, by weakening rules designed to provide much-needed information about certain business transactions, including one rule that has been in place for decades.

This House Republican tax package should be rejected out of hand and the legislation’s priorities should be re-ordered as the larger tax debate over parts of the 2017 tax law that expire in 2025 progresses. The goal should be to move away from failed trickle-down tax policies that haven’t delivered on the economic promises proponents touted. Instead, we should move toward a tax system that raises more revenues through progressive policies and uses those resources to make investments that make the economy work better for everyone.

Expanding the Child Tax Credit Should Be the Top Priority

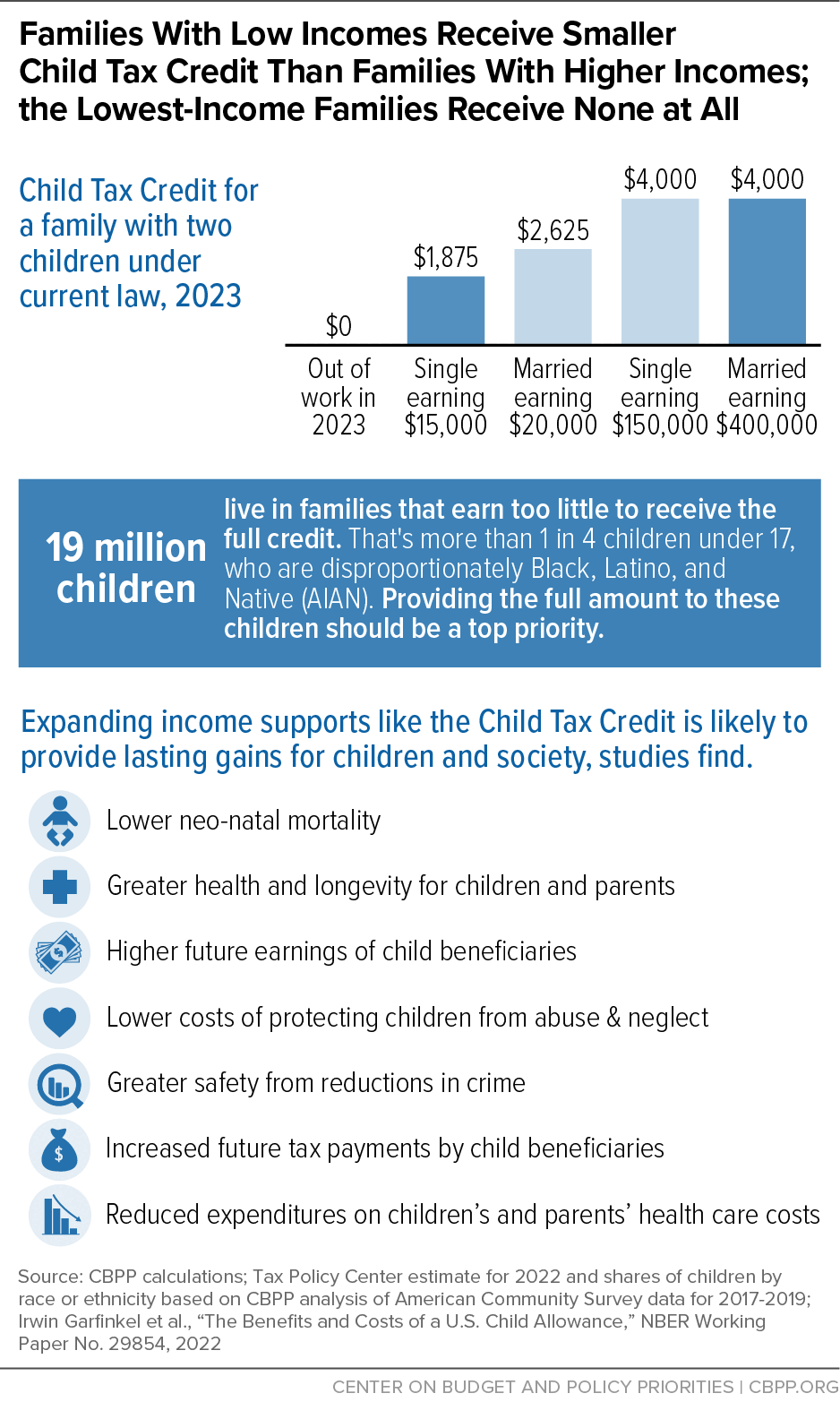

When the temporary Child Tax Credit expansion under the American Rescue Plan expired at the end of 2021, the credit reverted to the flawed design left in place by the 2017 Trump tax law. As a result, an estimated 19 million children — or more than 1 in 4 children under age 17 — will get less than the full Child Tax Credit or no credit at all because their families earn too little, while families with much higher incomes (up to $400,000 for married couples) will receive the full $2,000 credit for each child.[2]

Expanding the Child Tax Credit for these 19 million children should be the top priority of any tax bill this year. The House Ways and Means Committee legislation does not expand the Child Tax Credit, however; nor does it expand the Earned Income Tax Credit (EITC) for low-paid working adults not raising children at home. This is particularly disappointing given the success of the temporary expansions of these credits included in the American Rescue Plan.

Making the Child Tax Credit permanently available to these 19 million children would substantially reduce child poverty at a modest cost. Making the full $2,000 credit available to children in families with low incomes would cost roughly $12 billion per year through 2025, the Joint Committee on Taxation (JCT) estimated.[3] This change would reduce the number of children living in a family with income below the poverty line by roughly 16 percent — or about 1.5 million children — in 2023 relative to current law.[4] Increasing the maximum credit in addition to making the full credit available to children in families with the lowest incomes — as the Rescue Plan did for 2021 — would further reduce poverty.

While making the full credit available to children in families with low incomes would lower child poverty among all races and ethnicities, it would reduce poverty by a larger amount among Black, Latino, and American Indian or Alaska Native (AIAN) children, whose families are overrepresented in low-paid work due to past and present hiring discrimination, inequities in educational and housing opportunities, and other sources of inequality. By lifting larger shares of children of color above the poverty line, the expansion would narrow the differences in child poverty rates by race and ethnicity.

Roughly 46 percent of Black children, 39 percent of AIAN children, 37 percent of Latino children, 17 percent of white children, and 15 percent of Asian children get less than the full credit or no credit at all because their families’ incomes are too low to qualify for the full credit.[5] Making the credit more available to these children would push back against long-standing inequities, advance family income security, and broaden opportunity.

Raising income for families with children experiencing poverty can improve children’s outcomes in the short and long term. (See Figure 1.) That’s because poverty and the hardships that come with it — unstable housing and frequent moves, inadequate nutrition, and high levels of stress in the family — can take a heavy toll on children; they are associated with lower levels of educational attainment, poorer health in adulthood, and lower earnings in adulthood, a 2019 National Academies of Science, Engineering, and Medicine report on reducing child poverty found.[6]

The omission of an expanded EITC for workers without qualifying children at home is also problematic. Our current tax system taxes millions of people into, or deeper into, poverty, largely because the EITC they qualify for is too low to offset the federal taxes they owe (including payroll taxes). An expanded EITC for workers without children at home would address this problem at modest cost.

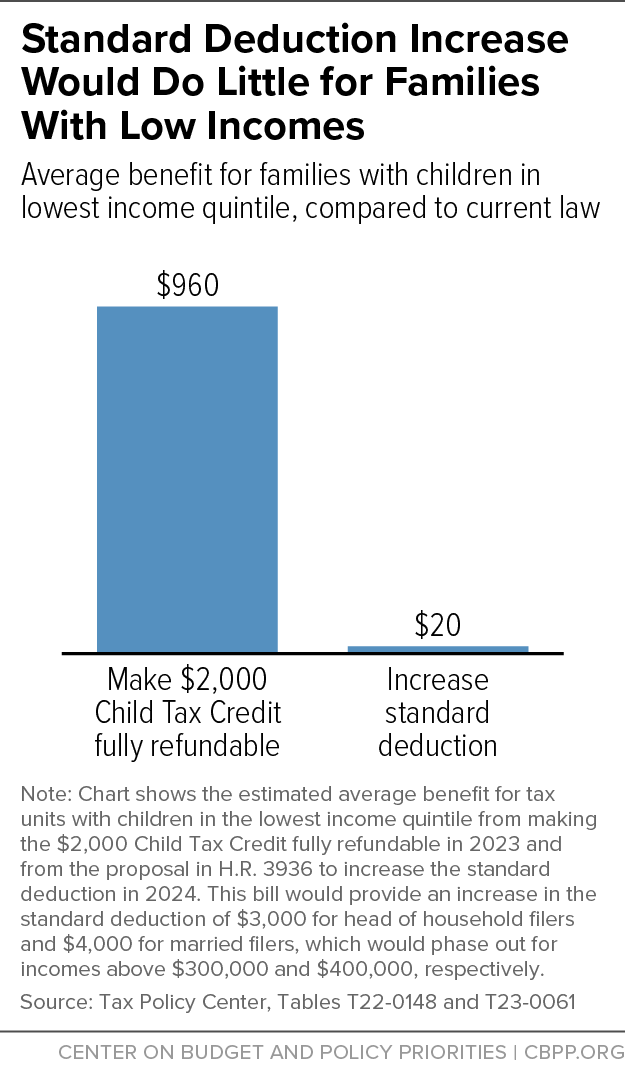

Increasing the Standard Deduction Is Not a Replacement for Expanding the Child Tax Credit

While the House Republican package excludes an expansion of the Child Tax Credit, it includes a temporary increase in the standard deduction (the amount that is deducted from a household’s income before determining the taxes they owe, for those households who don’t itemize their deductions). The standard deduction in 2023 is $13,850 for individuals, $20,800 for heads of household, and $27,700 for married couples.[7] The House Republican legislation would raise these by $2,000, $3,000, and $4,000 respectively for 2024 and 2025. These increases would be phased out beginning at respective income thresholds of $200,000, $300,000, and $400,000.

The impetus for this provision is unclear. It seems to be a proposal to mitigate some of the impact of the current cap on the state and local deduction. What is clear is that an expansion of the standard deduction is not a replacement for an expansion of the Child Tax Credit. (See Figure 2.)

An increase in the standard deduction delivers more to higher-income taxpayers because they face higher marginal tax rates: the higher the tax rate, the larger the benefit from the standard deduction increase. For low-income taxpayers with incomes below the current standard deduction amounts, an increase would deliver no benefit at all.

For example, a married couple with two children and an income of $400,000 could get a $4,000 higher standard deduction — worth $1,280 to them in 2023 — to go with their $4,000 current Child Tax Credit. By contrast, a single mother with two children, who earns $15,000 providing part-time child care for this richer family, would continue to get $2,125 less in the Child Tax Credit and would receive no benefit from the increase in the standard deduction at all.

The proposed two-year increase in the standard deduction would cost $96 billion, according to JCT, or roughly four times as much as making the full Child Tax Credit available to the 19 million children in low-income families who today receive a partial credit or none at all.[8]

The House Ways and Means tax package’s corporate provisions would give wealthy shareholders, including those living in other countries, new regressive windfall tax benefits and additional retroactive corporate tax cuts that can have no effect on business decisions about new investment. It pays for these expensive business tax breaks by moving the country backward in the fight against climate change, significantly scaling back the climate tax provisions in the Inflation Reduction Act designed to speed the nation’s transition to cleaner energy sources.

The new legislation must be understood in the context of the 2017 tax law, which was regressive and expensive, losing roughly $2 trillion over ten years. That legislation made a very large permanent cut in the corporate tax rate, largely benefiting wealthy shareholders.

To reduce the cost of the corporate cuts, the 2017 tax law included three partially offsetting corporate tax increases that were not slated to go into effect until 2022 and 2023: 1) scaling back a favorable tax treatment of research and experimentation (R&E) expenses; 2) slowing down how quickly businesses can deduct the cost of their equipment investments; and 3) limiting the deductibility of interest expenses. The House Ways and Means tax package would reverse these three provisions without reversing any of the deep cut in the corporate tax rate that these provisions were intended to partially offset.

Moreover, the legislation uses a classic timing gimmick to make it appear less costly. Instead of permanently reversing these tax increases and facing the full and substantial cost, the bill advances a temporary pause of the tax increases and reinstates them at the end of 2025, but with no intention of letting the provisions take effect.

The temporary nature of these provisions and their overall revenue pattern[9] can make it hard to clearly understand their true cost. Still, it’s clear that the cost would be substantial and its benefits highly regressive. Through 2025, these three provisions would lose $220 billion in revenue, JCT estimates[10] — that is, the bill would deliver more than $200 billion in tax breaks largely to profitable corporations, whose shareholders are disproportionately owned by the wealthy and foreign investors.[11] Making every provision in this tax package permanent would cost $950 billion over ten years, the Committee for a Responsible Federal Budget estimates; more than $500 billion of this comes from the three main corporate provisions.[12]

Beyond their cost and regressive properties, some of the provisions have serious design flaws, including making two of them retroactive, a wasteful giveaway that does nothing to encourage new investment.

Research and Experimentation Provision

In the 2017 tax law, congressional Republicans required companies to amortize their R&E expenses (that is, deduct the cost of these expenses over multiple years instead of claiming them all in the first year) beginning in 2022. Proponents of suspending the amortization provision argue that it would encourage businesses to invest in research and experimentation, which may have broader spillover benefits but can take years to show a financial return for the corporation. If full R&E expensing is going to be reinstated — as the House Ways and Means tax package calls for — it should be paid for by partially reversing the cut in the corporate tax rate.

There is no valid argument, however, for making full R&E expensing retroactive to 2022, as the legislation would also do. The decisions about how much a corporation invested in R&E in 2022 have already been made, and a different tax treatment applied retroactively can’t spur R&E investment in the past; it simply provides a windfall for investments that have already been made. This 2022 windfall would cost about $30 to $40 billion,[13] roughly three times the cost of the entire annual current $10 billion budget for the National Science Foundation (NSF) or more than 15 times the cost of the $1.8 billion increase for NSF the Biden Administration has proposed for 2024.[14]

Recent research underscores how valuable NSF funding and other government civilian research is to innovation and future productivity gains.[15] Yet House Republicans are aggressively trying to slash the part of the budget that funds the NSF and other critical research programs, making it harder to invest in research while proposing to spend billions of dollars on a retroactive tax break that gives no incentive to invest in future research.

The House Republican package would also loosen a limit on the amount of interest certain businesses may deduct. In the 2017 law, congressional Republicans imposed a new limit on the amount of interest expenses businesses can deduct, which primarily affects companies with large amounts of debt. To raise additional revenue, they tightened the limit starting in 2022, forcing more businesses to face the limit.

The House Republican tax package would repeal the tighter limit beginning in 2022 for electing companies, returning to the version that was in place before 2022. Like the provision allowing R&E expensing described above, allowing companies to retroactively elect a more generous tax break for their interest expenses in 2022 merely provides a windfall for past behavior rather than encouraging new activity. This change would cost nearly $14 billion from 2023-2025, according to JCT.[16]

Moreover, as discussed in greater detail below, the new legislation would combine looser limits on interest deductibility with a proposal to let businesses fully expense (or deduct) the cost of their investments. This means businesses that take out loans to buy equipment or other depreciable assets could essentially get a double tax benefit: a full deduction for the price of a purchased asset and a deduction for interest on the debt used to buy that asset. According to Jason Furman, former chair of President Obama’s Council of Economic Advisers, this double benefit is a “nearly fatal problem.”[17]

The tax package has it backward. A strong interest deduction limit lowers the existing subsidy for debt-financed investment, which benefits highly leveraged businesses, such as those owned by private equity funds. It also curtails multinational corporations’ ability to shift profits overseas by making large interest payments to foreign affiliates. Congress should instead tighten limits on interest deductions, especially if paired with more generous depreciation.

In addition to reinstating very favorable treatment of R&E expenses, the House Republican tax package would also extend generous expensing of companies’ plant and equipment costs. For tax years 2018 to 2022, the 2017 tax law let businesses deduct 100 percent of the cost of equipment in the year that they bought it, known as “full expensing,” rather than deducting the cost over a set number of years. The law phased down this benefit to an accelerated or “bonus” depreciation schedule from 2023 through 2026 as a way to raise revenues later in the ten-year budget window, which helped reduce the large cost of the tax cuts. The House bill would extend the full expensing period through 2025.

Like the R&E provision, temporarily delaying the phase-down of full expensing and bonus depreciation masks the true cost of the tax break if it were made permanent. That’s because an official cost analysis shows costs while full expensing is in effect, but then shows revenues increasing in the years after full expensing is assumed to expire (above what the provision would have generated if no delay had taken place).

That is, while JCT estimates the ten-year cost of a temporary delay at only $3 billion, the provision would cost around $70 billion from 2023-2025 when full expensing would be in effect. And the Congressional Budget Office (CBO) has estimated that if full expensing were made permanent, the ten-year cost would be $325 billion, or $33 billion per year.[18] Congress should not extend more generous expensing without a corresponding increase in the corporate tax rate to make up for this large revenue loss.

These business tax breaks would come on top of the 2017 tax law’s massive reduction in the corporate tax rate. If policymakers want to create special treatment for various kinds of corporate expenditures, thereby narrowing the tax base on which the corporate tax is imposed, they should pay for those base-constrictors by increasing the tax rate applied on that narrow base. Indeed, the classic corporate tax reform tradeoff is between how broad the tax base is and how high the tax rate that then applies, with common calls to “lower the rate and broaden the base.”

With this new proposal, House Republicans are seeking to couple a low rate with a narrower base, which would give large tax breaks to corporate shareholders and generate less revenue to fund critical national priorities.

Proponents of low corporate taxes argue that if corporations pay lower taxes, they will invest more and increase employee wages, leading to more economic growth — a classic trickle-down argument. But there is little real evidence to back this up. Instead, executives, disproportionately wealthy corporate shareholders, and highly paid employees have reaped virtually all the economic gains from the corporate rate cuts, research suggests.[19]

Finally, the House Ways and Means tax package’s troubling combination of excessive corporate tax breaks without a corresponding increase in the corporate tax rate is compounded by their choice of offsets — a significant scaling back of the climate tax provisions in the Inflation Reduction Act designed to speed the nation’s transition to cleaner energy sources. The Inflation Reduction Act is widely seen as an important first step in addressing climate change, and the House Republican tax package would undermine that nascent but critical progress.

Specifically, the bill would repeal new tax credits for investment in and production of electricity from zero-emission sources (which includes additional amounts for clean energy investments located in certain low-income communities). The bill would also cut the Inflation Reduction Act’s significantly expanded tax credits for purchasing new or used electric vehicles.

There are daily reminders for policymakers on the severity and urgency of the climate crisis, whether it’s water shortages in the West, the increasing difficulty of homeowners in disaster-prone areas to secure insurance, or the recent report on the difficult-to-fathom pressure for potential mass migration.[20] The House Republicans released their tax package in Washington the day after the air was at a dangerous “code purple” because of smoke from Canadian wildfires. Policies to address climate change must be implemented, not undone.

After House Republicans’ recent effort to undermine the IRS during the recent debt limit debate,[21] the new tax package again seeks to limit the agency’s ability to improve tax compliance. The bill would weaken two existing provisions that require certain businesses to provide information to the IRS about types of taxable payments that contribute disproportionately to the tax gap.

First, the package would repeal a Rescue Plan provision strengthening tax information reporting requirements applicable to certain payment processors (like Venmo or PayPal) and “gig economy” platforms. Before the Rescue Plan, such platforms were required to send payment information to the IRS (and to business owners, who can then use the information to help them accurately file tax returns) only if an individual’s transactions totaled at least $20,000 in payments and at least 200 separate payments via the platform. The Rescue Plan provision requires third-party payment platforms like Venmo to report payment information if payments to a business owner exceed $600 — the same requirement that already applied to credit card companies that process payments made to business owners.[22]

The House Republican legislation would revert to the prior-law thresholds of $20,000 in total payments and 200 transactions per platform. But these higher thresholds were subject to significant abuse: if owners could organize their businesses to avoid crossing either the payment or transaction threshold, payment processors were not required to report that income to the IRS — though the owner would still be liable for the tax on that income. Repealing the Rescue Plan provision would cost nearly $10 billion over ten years, according to JCT, due to decreased tax compliance.

The Rescue Plan’s lower reporting threshold of $600 did not increase taxes on anyone; businesses receiving payments via these payment platforms have always been required to report these payments on their tax returns. Furthermore, the additional reporting burdens generally fall on large corporations that own and operate the payment platforms, which have the resources and ability to implement the Rescue Plan’s changes. Any concerns about undue administrative burdens on people who receive personal payments on such platforms can be addressed in implementation.[23]

The House Republican package would also weaken long-standing reporting rules that apply to businesses making payments to service providers, such as independent contractors, by raising the annual reporting threshold to $5,000 from the current $600 and indexing the threshold for inflation. This would similarly create more opportunities for tax evasion, while making it harder for honest contractors to accurately file their taxes. It is also costly: it would reduce revenues by $14.5 billion over ten years, according to JCT, due to reduced tax compliance.

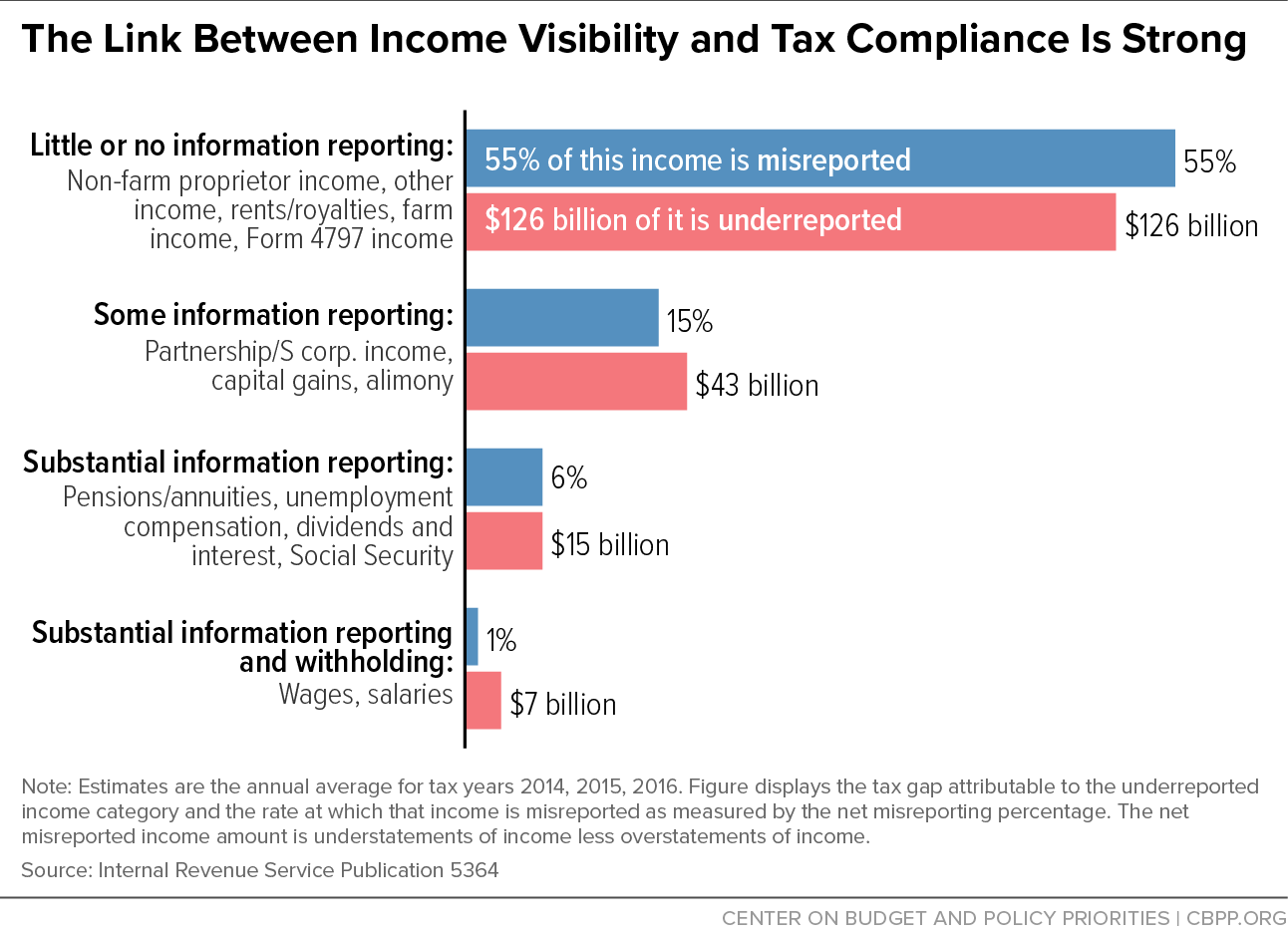

Our voluntary tax compliance system relies on third-party information to function. For income that’s subject to substantial information reporting, such as wages (which employers must report to the IRS using W-2 forms), compliance is near perfect. But for certain streams of income where the IRS has little or no third-party information, like those the provisions the House Republican package would weaken, more than half of income goes unreported. (See Figure 3.)

Policymakers should find ways to increase the information the IRS has on taxable payments, instead of weakening existing provisions. House Republicans and other policymakers should recognize the critical role information plays in tax compliance and how it is unfair to honest taxpayers to enact policies that would make it easier for some people to cheat on their taxes.

The 2017 tax cuts (as well as those enacted in 2001 and 2003) have reduced revenues markedly, driving deficits up and limiting federal policymakers’ willingness to make investments in people, communities, and the economy.[24] In their new tax package, the House Republicans are proposing policies that double down on trickle-down.

The 2025 expiration of the individual provisions of the 2017 tax cuts provides an opportunity for a course correction — to move away from the flawed trickle-down path of ever-larger tax cuts for the wealthy and profitable corporations and toward a tax code that raises additional much-needed revenue, is more progressive and equitable, and supports investments that make the economy work for everyone.[25]

This course correction should include rethinking the centerpiece of the 2017 tax law, the deep cut in the corporate tax rate from 35 percent to 21 percent. This corporate tax cut faced strong public opposition from the start, and the case against it has only grown as it has failed to deliver the benefits the law’s drafters promised. Cutting the corporate tax rate cost significant revenue without any clear economic benefits for employees.[26]