BEYOND THE NUMBERS

A new Congressional Research Service (CRS) report shows that federal spending on low-income programs has risen significantly in recent years. Does this mean that safety net programs are growing out of control and are a major cause of the nation’s long-term budget problems, as some have suggested? No.

As we explained in May, virtually all of the recent growth in spending for means-tested programs is due to the recession and rising costs throughout the U.S. health care system, which affect costs for private-sector care at least as much as for Medicaid and other government health programs.

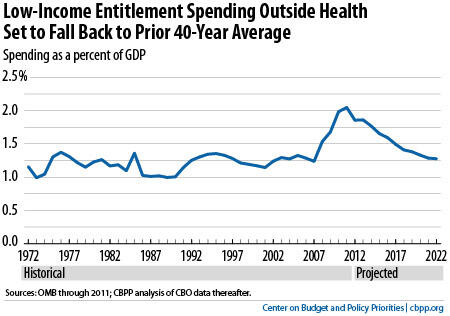

The Congressional Budget Office (CBO) projects that federal spending on means-tested programs other than health care will fall substantially as a percent of gross domestic product (GDP) as the economy recovers (see graph) — and fall below its 1972-2011 average.

Here are the specifics:

- Federal spending for mandatory programs outside health care, including refundable tax credits such as the Earned Income Tax Credit, averaged 1.3 percent of GDP over the past 40 years. This spending reached 2.0 percent of GDP in fiscal year 2011, a substantial increase. But CBO projects that it will return to 1.3 percent by 2020 and then remain there.

- Federal spending for low-income discretionary programs is virtually certain to fall as a percent of GDP in the coming decade as well. Under the 2011 Budget Control Act’s funding caps, non-defense discretionary spending will fall over the decade to its lowest level as a percent of GDP since 1962 (and probably earlier).

- As a result, total spending for low-income programs outside health care — both mandatory and discretionary — is expected to fall below its prior 40-year average.

Since these programs aren’t rising as a percent of GDP, they do not contribute to our long-term fiscal problems.

To be sure, Medicaid is projected to rise significantly as a share of GDP, largely because of the growing cost of health care throughout society. Medicaid, however, isn’t the cause of this systemwide cost growth.

Per-beneficiary costs have risen more slowly in Medicaid than under private insurance over the past decade and are expected to continue doing so. Moreover, it costs Medicaid much less than private insurance to cover people with similar health status because Medicaid pays providers lower rates and has lower administrative costs. And the health reform law is testing new methods of delivering health care, which hold the promise of cutting costs and improving the quality of care throughout the U.S. health care system.