BEYOND THE NUMBERS

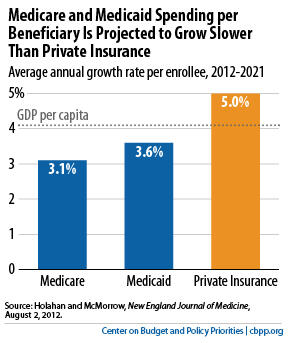

Medicare and Medicaid spending per beneficiary has grown less rapidly than costs for private health insurance in recent years, as we have previously pointed out. (See here and Figure 1 here.)

This favorable trend is projected to continue for at least the coming decade, according to a new article in The New England Journal of Medicine. These data belie the claim that spending for Medicare and Medicaid is “out of control” and that the programs must be fundamentally restructured by adopting Medicare premium support or converting Medicaid into a block grant.

Medicare and Medicaid spending per enrollee will grow at rates of 3.1 percent and 3.6 percent, respectively, over the next ten years — well below the projected growth rate of 5.0 percent for private insurance and somewhat less than the growth of gross domestic product (GDP) per capita. (See figure.) John Holahan and Stacey McMorrow of the Urban Institute, a nonpartisan research organization, base these estimates on the latest projections of national health expenditures prepared by the Office of the Actuary at the Centers for Medicare & Medicaid Services.

Looking at these trends, Holahan and McMorrow conclude:

With the per-enrollee spending growth in Medicare and Medicaid less than that in private insurance and close to the growth in GDP per capita, it’s hard to argue that spending on either program, on a per-enrollee basis, is “out of control.”. . . Policy options such as premium support and block grants that entail indexing growth rates to some measure of economic growth will have a hard time achieving lower per-enrollee spending growth than is currently projected. CBO estimates suggest that both approaches may achieve savings for the federal government, but such savings shift Medicare costs onto existing enrollees and, in the case of Medicaid, onto the states as well. . . . Rather than pursuing major restructuring of either program, then, we should continue adopting available strategies to contain costs within the programs’ current structure, especially since many of those implemented in the past decade seem to be working, and many on the horizon appear promising.

We agree.