Earlier this month, the Department of Housing and Urban Development (HUD) announced an important policy change to better adjust subsidy caps — known as Fair Market Rents, or FMRs — in the Housing Choice Voucher program to keep pace with rapidly rising market rents.[1] The new policy will, for the first time, use up-to-date private rent data to help set FMRs. This ensures that FMRs better reflect housing costs in local communities and allows, where needed, higher subsidies that can make it easier for families to find housing with their voucher.

Vouchers are highly effective at reducing homelessness, overcrowding, and housing instability and can enable people with low incomes to rent housing in a wider range of neighborhoods. But to maximize the benefits, the state and local housing agencies that administer the voucher program should implement the change promptly and effectively, so that subsidies better reflect the actual cost of housing in their communities.

Vouchers help more than 2 million low-income households — most of them seniors, people with disabilities, and families with children — rent homes in the private market. Households with vouchers generally pay 30 percent of their income for rent, and the voucher covers the gap between the household’s payment and the lower of (1) the market rent; or (2) a “payment standard” set by the housing agency. Agencies generally must set their payment standards between 90 and 110 percent of the FMR, which HUD calculates each year (for metropolitan areas, zip codes, and counties within each state) based on typical rent and utility costs for moderately priced housing in the local market.

When they accurately reflect market conditions, FMRs help ensure that voucher subsidies are adequate to rent good-quality housing in a range of neighborhoods, but not higher than needed (which would reduce the number of families agencies can assist with the limited funds available to them). If FMRs and payment standards are too low, however, some voucher holders may not be able to use their vouchers. Inadequate FMRs shrink the pool of available units whose market rent falls below the payment standard. This creates more administrative work for renters, who may need to search longer and apply to far more units. Lengthy housing searches are especially burdensome for people who are already unhoused and may be living in a shelter, car, hotel, or motel. In the worst cases, some renters fail to find any housing in the time allotted and must return the voucher to the housing authority. Losing their housing assistance can put these renters at risk of homelessness, eviction, and other hardship.

Other renters may only be able to rent units in a very limited range of neighborhoods, which can reinforce racial and economic segregation. The loss of neighborhood choice is significant given the history of housing policy in the United States. Racist federal, state, and local housing policies[2] have systematically excluded renters of color — especially Black renters — from certain neighborhoods, schools, and jobs, as well as wealth-building opportunities like homeownership. The effects of these policies have compounded over time, resulting in people of color being more likely to be renters,[3] face high housing cost burdens, live in doubled-up or overcrowded conditions,[4] be evicted,[5] and experience homelessness.[6]

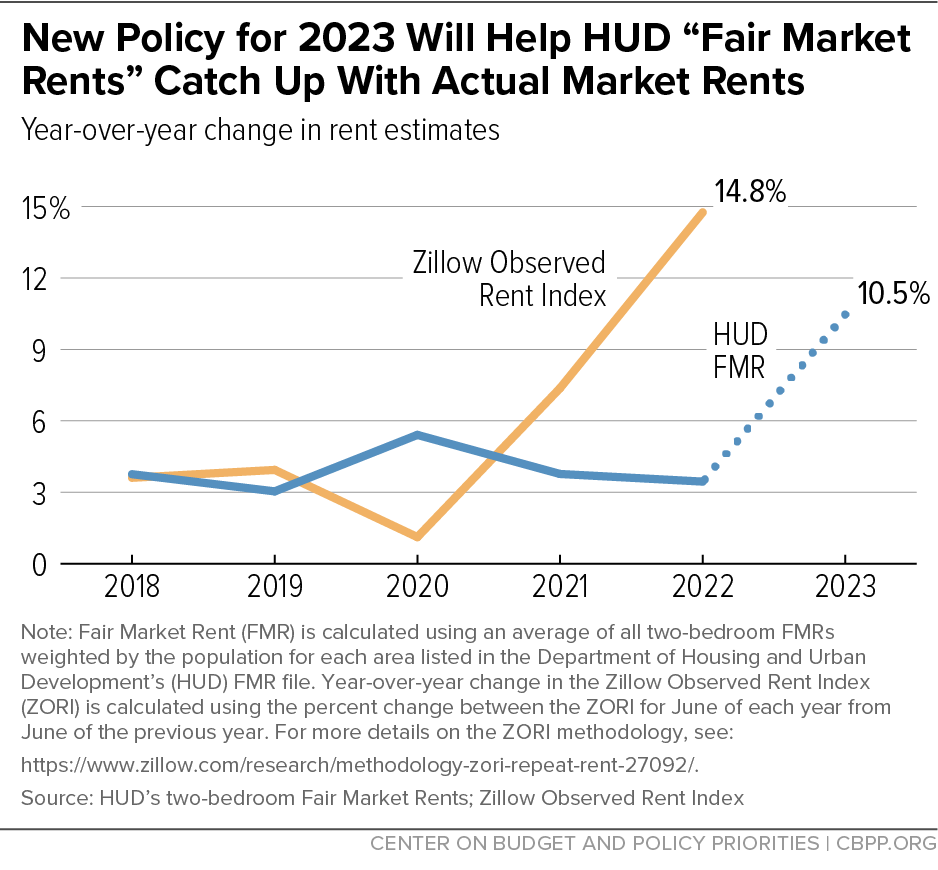

Under HUD’s prior policy, FMRs were often too low when market rents in an area were rising rapidly. That’s because none of the federal data sources HUD used to set FMRs provides recent data on newly rented units, and those data are crucial to accurately measuring sharp rent increases.

One source, the American Community Survey, is only released annually and is substantially out of date by the time HUD sets FMRs. Another, the Consumer Price Index, tracks changes in the average rent paid by all renters, which reflects market shifts much more slowly than rents for newly rented units alone. Households that newly receive vouchers often move, particularly if they were previously homeless, so the rents they will need to pay are more accurately measured by rents of newly rented units. This shortcoming has become especially problematic in 2021 and 2022, as rents surged across the country and FMRs fell further behind. (See Figure 1.)

HUD’s new policy is intended to set FMRs for 2023 that better reflect recent increases in market rents. Under the policy, HUD will use private rent data from six companies (including Zillow and ApartmentList) to supplement the public data sources it used in the past. Those private sources include recent data on newly rented units, so including them in HUD’s calculations makes FMRs more responsive to recent rent growth. The impact varies from one region to another, but overall the 2023 FMRs are 10 percent higher on average than the 2022 FMRs — a major increase that can be expected to make it much easier for many voucher holders to rent homes that meet their needs.

While this is an important step forward, HUD is still considering whether and how to use private data in 2024 and beyond. Using proprietary private data has drawbacks, since HUD can’t fully disclose details about the data; for some of the sources there is only limited public information on how the data were gathered and how comprehensively they cover the rental market. There is also no guarantee that data providers will continue making the same data available over time. Because private data is an imperfect substitute for government surveys, HUD should work with agencies such as the Census Bureau or Bureau of Labor Statistics to develop a public source of recent mover rent data that can ultimately replace the private data. HUD should continue to use private data until a public source becomes available, but in the meantime, it should regularly evaluate the private data sources and drop any sources that are not improving the accuracy of FMRs.

The impact of the higher, more accurate FMRs HUD has set for 2023 will depend in part on actions by state and local agencies. Agencies should take several steps to maximize the benefits for people served by the voucher programs.

- Implement the change promptly. Agencies are required to raise their payment standards to fall between 90 and 110 percent of the new FMRs by January 1, 2023, but they are allowed to do so as soon as October 1, 2022. They should act promptly to increase their payment standards if this is needed to cover typical market rents in their community.

- Set payment standards that reflect neighborhood-level rents. Most voucher agencies use FMRs set by HUD for an entire metropolitan area or rural county. Even if these FMRs are accurate for that broader area, they are usually too low to use a voucher in many neighborhoods — often including well-resourced neighborhoods with access to high-performing schools and other amenities. But HUD also sets ZIP code-level Small Area Fair Market Rents (SAFMRs) that better reflect rents in individual neighborhoods. Housing agencies in 24 metropolitan areas must use SAFMRs, but agencies in any metropolitan area have the option to set payment standards up to 110 percent of the SAFMR in any or all of the ZIP codes they serve, which can both make vouchers easier to use and substantially broaden housing choice. The only action HUD requires an agency to take to use this option is to notify HUD by e-mail that it is doing so.[7]

- Use added flexibility to raise payment standards further if needed. In areas where rents are continuing to rise sharply, even payment standards at 110 percent of the new FMRs (or SAFMRs) may not be sufficient to keep pace with the rental market and ensure voucher holders have meaningful choice about where they live. In December 2021, HUD temporarily allowed voucher agencies in much of the country to easily raise payment standards to 120 percent of the FMR or SAFMR, and in a notice issued on September 26, 2022, HUD extended that option (which had been scheduled to expire at the end of 2022) through December 2023. The new notice allows agencies that have not used this option to request approval to do so and permits agencies that had previously received approval to request extensions, both through e-mails to HUD. (Agencies outside the geographic areas covered by the notice can also request approval for payment standards above 110 percent of the FMR and all agencies can request approval for payment standards above 120 percent, but HUD may require agencies to submit additional evidence showing that payment standards at those levels are needed and the process may take longer.)

- Implement other policies to make vouchers easier to use and expand housing choice. Adequate payment standards are needed to enable voucher holders to afford stable housing in a wide range of neighborhoods, but they aren’t enough on their own. State and local policymakers should take other steps too, such as prohibiting landlords from discriminating against voucher holders and providing counseling and other support to help families with their search. In June 2022, HUD published a notice clarifying that voucher agencies can use their administrative funding to help voucher holders pay for security deposits and for incentive payments to landlord who rent to voucher holders — both steps that could make vouchers significantly easier to use.[8]

Some housing agencies may hesitate to implement the new FMRs promptly and take other steps to raise payment standards out of concern that more adequate voucher subsidies will raise program costs. But in practice the impact of the change on costs will be gradual, since only a small percentage of vouchers turn over to new households each year, and payment standard increases will have no immediate impact on the large share of voucher holders (about two-thirds according to HUD data) with rents at or below the current payment standard. In addition, HUD plans to incorporate the new FMR into the inflation factors it uses to set voucher funding levels, so agencies will be eligible for added funding to cover the cost of using payment standards that accurately reflect market rents. Furthermore, well-managed housing agencies generally maintain reserves of voucher subsidy funds to cover unexpected costs stemming from rent increases or other factors.[9]