BEYOND THE NUMBERS

House Budget Committee Chairman Paul Ryan’s new budget again proposes to radically restructure Medicaid by converting it into a block grant and to slash federal funding by about one-fifth over the next decade (as well as to repeal health reform’s Medicaid expansion). All told, it would add tens of millions of Americans to the ranks of the uninsured and underinsured.

Repealing the Affordable Care Act’s Medicaid expansion means that 17 million people would no longer gain Medicaid coverage, while the large and growing cut in federal Medicaid funding would almost certainly force states to sharply scale back or eliminate Medicaid coverage for the millions of low-income people who rely on it today.

- The block grant would cut federal Medicaid spending by $810 billion over the next ten years (2013-2022). That would be a cut of about 22 percent compared to current law. (This doesn’t count the loss of the large additional funding that states would receive to expand Medicaid under health reform.)

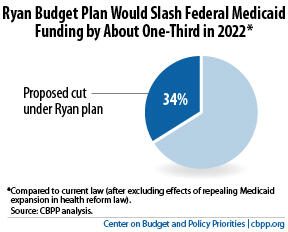

- Block grant funding amounts would fall further and further behind state needs each year. The annual increase in the block grant amounts would average more than 3.5 percentage points less than Medicaid’s currently projected growth rate over the next ten years, which accounts for factors like rising health care costs and an aging population. In 2022, we estimate that federal Medicaid funding would be about 34 percent less than states would receive under current law. And the cuts would keep growing after 2022. The Congressional Budget Office (CBO) expects that, under the Ryan plan, federal Medicaid (and CHIP) spending as a share of the economy would fall by half by 2040, compared to spending levels in 2011.

- The loss of federal funding would be even greater in years when enrollment or per-beneficiary health care costs rose faster than expected, such as during a recession or after the introduction of a new health care technology or treatment. Currently, the federal government and the states share in those unanticipated costs; under the Ryan plan, states alone would pay them.

As CBO concludes, “the magnitude of the reduction in spending . . . means that states would need to increase their spending on these programs, make considerable cutbacks in them, or both. Cutbacks might involve reduced eligibility . . . , coverage of fewer services, lower payments to providers, or increased cost-sharing by beneficiaries — all of which would reduce access to care.” In making these cuts, moreover, states would likely use the expansive new flexibility that the Ryan plan would give them. For example, the plan would likely let states cap Medicaid enrollment and turn eligible people away from the program; under current law, they must accept all eligible individuals who apply. It also would likely let states drop certain benefits that people with disabilities and special health care problems need.

The Urban Institute estimated that Chairman Ryan’s block grant proposal of last year would lead states to drop between 14 million and 27 million people from Medicaid by 2021 (outside of the effects of repealing health reform’s Medicaid expansion) and cut reimbursements to health care providers by 31 percent. There’s no reason to think that this year’s proposal would result in cuts that are any less draconian.