Report

A Guide to Statistics on Historical Trends in Income Inequality

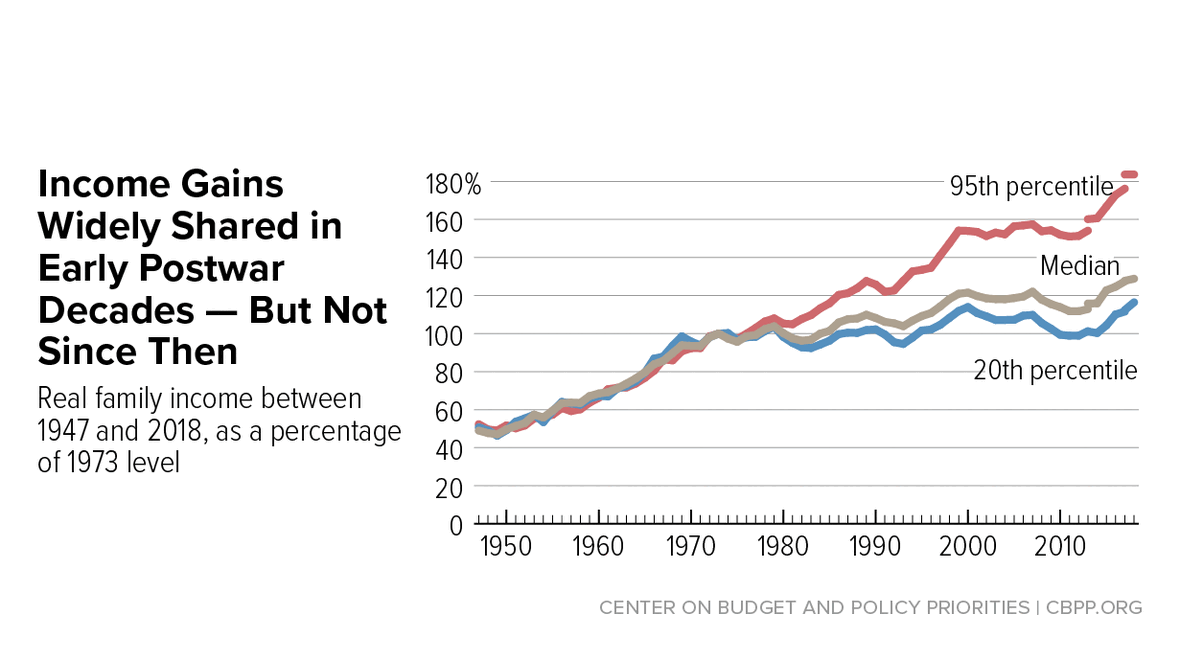

The years from the end of World War II into the 1970s were ones of substantial economic growth and broadly shared prosperity. Beginning in the 1970s, economic growth slowed and the income gap widened.