BEYOND THE NUMBERS

As Washington focuses on critical budget decisions, former Treasury Secretary Bob Rubin has a perfectly timed op-ed in the New York Times that makes a convincing case for returning to the Clinton-era tax rates on incomes over $250,000 as part of a balanced deficit-reduction package.

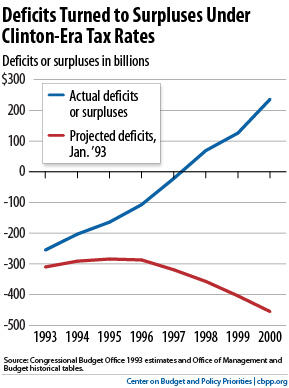

Just like today, critics warned that raising the top rate would wreck the economy and the promised deficit reduction would not occur. The opposite happened: economic growth averaged nearly 4 percent annually over the Clinton years, helping turn large deficits into large surpluses (see graph).

Seeking to avoid raising tax rates, many lawmakers are focused on scaling back tax deductions, credits, and other preferences, which are known collectively as “tax expenditures.” One problem, however, is that, for the most part, these tax expenditures are not what most Americans would consider “loopholes.” Instead, they are popular and widely used tax preferences, such as the tax-free treatment of employer-provided health care, the deduction for home mortgage interest, and the deduction for charitable giving. As a result, policymakers will find it politically difficult to scale back these and other popular provisions to any great extent.

“Reducing tax expenditures to pay for both lower personal income tax rates and deficit reduction may seem like a politically attractive alternative to raising tax rates or cutting entitlements or other spending,” Rubin notes. But, he warns, pursuing large cuts in tax expenditures could have us go “down a road that leads nowhere.”

Policymakers should heed Rubin’s advice: let the Bush high-end tax cuts expire and return to the Clinton-era top tax rates.