BEYOND THE NUMBERS

The Reality of Raising Taxes at the Top, Part 5: Can Tax Increases Help Economic Growth?

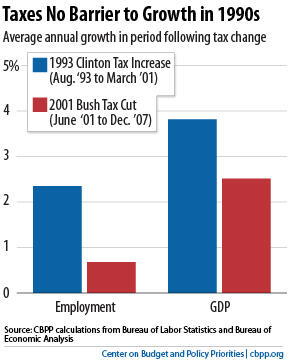

In this blog series, and in our new report, we’ve considered how raising taxes at the top might affect economic growth. We’ve found no convincing evidence that raising taxes at the levels that policymakers are considering would negatively affect high-income people’s reporting of taxable income, the amount they work, their saving and investment, the health of small businesses, or the rate of entrepreneurship. But what if we look directly at the relationship between taxes on high-income people and growth?

The Clinton-era tax rates and revenues enabled budget deficits to fall, increasing national saving and reducing the long-term costs of borrowing, and this may have enabled the private sector to increase investment in ways that improved growth. Similarly, the Congressional Budget Office finds that letting the Bush tax cuts expire on schedule would strengthen long-term economic growth, if policymakers use the revenue to reduce deficits.

That’s critical: how the government uses the revenue generated by tax increases largely determines how the tax hikes affect growth. Cuts or increases to tax rates do affect behavior, Urban-Brookings Tax Policy Center co-Director William Gale told journalists during a conference call last week. “[B]ut they also have effects on the deficits, and those deficits’ impact on growth can be far larger than the incentive effects that are created.” (You can listen to the call here.) What’s more, the revenue from tax increases can fund — or prevent cuts to — investments in areas that support economic growth, such as infrastructure and education.

Tomorrow, in the final installment of this series, we’ll look at how policymakers might consider raising taxes at the top.