BEYOND THE NUMBERS

Lawmakers Should Prioritize Adequate Funding for Rental Assistance for People Struggling to Afford Housing in Housing Appropriations Legislation

Although the final debt ceiling deal protects defense funding from cuts, it limits overall funding for non-defense programs funded through annual appropriations bills (often called “non-defense discretionary funding” or “NDD”) to current levels without adjusting for inflation — and the House Appropriations Committee has moved to push funding well below the agreed upon level. The NDD part of the budget funds federal rental assistance, which lifts more people above the poverty line than all other non-defense discretionary programs combined. Congress should — as it has in the past — prioritize providing adequate funding for vouchers and other rental assistance programs to, at a minimum, avoid reducing the number of families who will receive this assistance. Cuts in the number of households receiving assistance will drive up rates of evictions and homelessness. Specifically, the housing appropriations legislation should, at a minimum, fully fund the cost of existing housing vouchers and other rental assistance programs.

The negotiated budget caps in 2024 and 2025 will result in cuts overall when the real impact of inflation is taken into account. This is particularly harmful for federal rental assistance programs because they are tied to rental costs, which have had higher-than-overall rates of inflation in recent decades. Housing vouchers and other rental assistance that adjust for rising costs require annual, inflation-related increases to continue serving the same number of families, which already is only a small fraction of those in need due to existing funding limitations. Given this, significant increases in funding are usually needed to prevent cuts in assistance. The President’s budget requested an additional $2 billion beyond the 2023 level to simply renew existing vouchers in 2024, as well as $565 million to provide rental assistance to an additional 50,000 households.

The Senate and final legislation should provide at least the agreed upon overall NDD funding levels. Even at those funding levels, there are a number of factors that will make securing adequate funding for key priorities challenging. The cost of many NDD programs go up with inflation as costs rise. In addition, Congress relies on revenues created through the Federal Housing Administration's (FHA) mortgage insurance programs to help fund non-defense discretionary programs. However, due to factors such as the increase in interest rates, revenues from mortgage transactions are projected to be down in 2024 compared to 2023. These FHA receipts are accounted for in the same appropriations bill that fund the Department of Housing and Urban Development (HUD) overall, including rental assistance programs. Congress will need to ensure the funding allocation for the housing and transportation appropriations bill is sufficient after taking into account the reduction in expected receipts.

Congress also has previously prioritized maintaining housing vouchers and other rental assistance by providing sufficient funding to renew all vouchers in most years, even when overall funding has been tight and Congress has been divided. For example, when the Budget Control Act of 2011 imposed caps from 2012 to 2021, which were more austere than those in the recent debt ceiling agreement, members of both parties in the House and Senate often worked together to prioritize renewing existing housing vouchers. And in some years, when Congress raised spending caps but funding remained tight, policymakers prioritized providing some additional, targeted housing vouchers.

Congress has also included language in previous appropriations bills that allows HUD to stretch limited resources to avoid cuts in the number of households served. Congress should support the Administration’s proposal in the 2024 budget request to grant HUD important, additional authority to reallocate unused resources to state and local housing agencies that need them most.

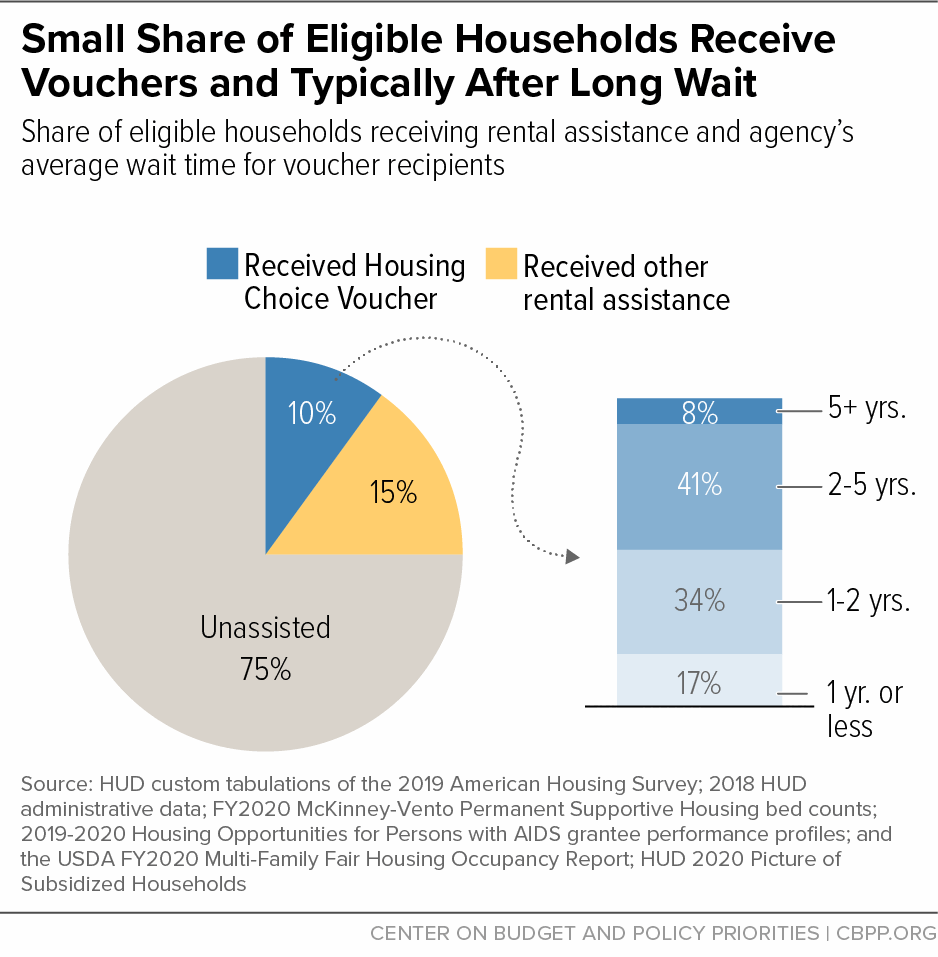

Maintaining housing vouchers and expanding rental assistance is critical. Rental assistance programs are currently funded at a level where only 1 in 4 eligible households receives assistance. The lack of assistance leads to people waiting years on long lists while continuing to face the harms of housing instability. (See graphic.) And because of a lack of investment, an estimated 583,000 people were experiencing homelessness on a single night in January 2022 (the most recent data available) — about 40 percent of whom were in unsheltered locations with no safe place to eat, shower, or peacefully rest. Housing is a necessity and a human right. Cutting programs that help people live in safe homes will unnecessarily put people’s well-being and safety at risk.

Moreover, restricting or reducing rental assistance exacerbates racial inequities. Because of long-standing inequities stemming from structural racism in housing, education, and employment, Black, Latine, Asian and Pacific Islander, and American Indian and Alaska Native people are disproportionately impacted by the underfunding in affordable housing.

Many policymakers recognize the tremendous benefits of stable housing that Housing Choice Vouchers and other types of rental assistance provide. And local housing agencies and communities can continue to emphasize the importance of affordable housing by using all their existing resources, including housing voucher funding.

Ultimately, the nation needs to make a substantially larger federal investment to address the millions of households who face unaffordable housing costs, housing instability, and homelessness and ensure that all people can afford safe, stable housing. Cuts that limit funding for housing vouchers and other critical programs that improve people and communities’ well-being take us further from that goal.