BEYOND THE NUMBERS

If we give the country’s highest-income households billions of dollars in added tax cuts, we’ll have to find billions in savings to offset the cost, on top of the cuts imposed as part of a deficit-reduction plan. That would make key programs ranging from Medicare to education, basic research, food safety, defense, and homeland security more vulnerable to deep cuts.

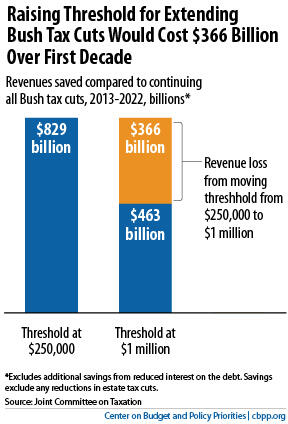

Raising the threshold to $1 million would cost $366 billion over ten years; raising the threshold to $500,000 would cost about $156 billion. As we’ve blogged, the Joint Committee on Taxation, Congress’ official scorekeeper for tax policy, found that letting the tax cuts above $250,000 expire would raise $829 billion over the next decade. We’d raise 44 percent ($366 billion) less if we moved the threshold to $1 million (see first chart).

Similarly, the Tax Policy Center recently found that raising the threshold to $1 million loses nearly 40 percent of the revenue savings in 2013 from letting the high-end tax cuts expire. Even raising the threshold to $500,000 would lose about 20 percent of the savings in 2013. That translates to about $156 billion in lost savings over the next decade.

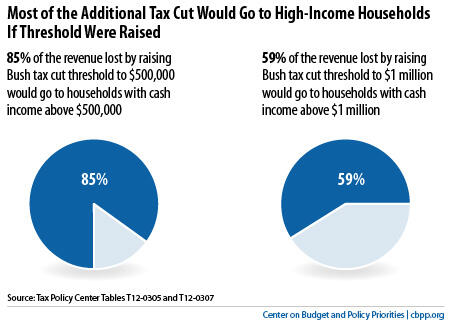

The added tax cuts from raising the threshold would go overwhelmingly to households above the higher threshold, because only they would get tax cuts on the full amount of the increase. If we raised the threshold from $250,000 to $500,000, for example, households over $500,000 would continue to get the Bush tax cuts on all of their income between $250,000 and $500,000. As a result:

- Households with cash incomes above $500,000 would get 85 percent of the additional tax cut (that is, the tax cut on top of what households would get on their first $250,000 of income). Millionaires would get 39 percent of it.

- The average additional tax cut in 2013 would be about $8,570 for households above $500,000 and about $10,610 for millionaires.

If we raised the threshold from $250,000 to $1 million:

- Households with cash incomes above $1 million would get 59 percent of the additional tax cut (see second chart).

- Millionaires would receive an average additional tax cut of about $31,610 in 2013.