BEYOND THE NUMBERS

Vote to Eliminate SSBG Program for Vulnerable People Continues Disturbing Pattern

The House Budget Committee will consider a package of budget cuts next week that includes eliminating the Social Services Block Grant (SSBG). The Ways and Means Committee voted last month to eliminate the $1.7 billion-a-year program, which states use to help fund specialized services to some of their most vulnerable populations, primarily low- and moderate-income children and the elderly and disabled.

As our new paper explains, eliminating the SSBG is unjustified on its own terms and particularly troubling in the context of other cuts the House is considering.

The SSBG supports services designed to help people become more self-sufficient, prevent and address child abuse, and support community-based care for the elderly and disabled. For example, roughly a quarter of SSBG funds help vulnerable and elderly adults, such as through day care services to help elderly adults continue living in their own homes and protective services to address abuse and exploitation of older adults.

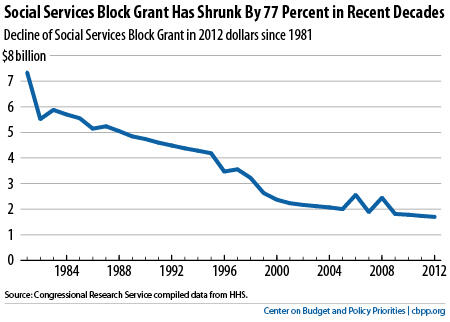

Although the SSBG has received bipartisan support from governors and members of Congress, funding has already fallen 77 percent since 1981 due to inflation, funding freezes, and budget cuts (see graph). That’s made it much harder over time for states to continue the services it supports.

Contrary to recent claims that the SSBG duplicates other federal programs, states use it to provide services for which there is no dedicated funding stream or where funding is inadequate. Child care assistance is a good example: despite the various funding streams used to support it, only one in six low-income working families eligible for federally supported child care assistance actually receives it. Eliminating the SSBG would worsen that shortage.

It’s also worth noting that the Government Accountability Office (GAO)’s recent comprehensive survey of duplication and overlap in the federal government makes no mention of any duplication related to the SSBG.

The effort to eliminate the SSBG is part of a disturbing pattern. As our report explains:

Voting to eliminate the SSBG continues a troubling recent trend in the House of cutting or eliminating programs that help vulnerable people. The House budget requires the Ways and Means Committee to find $53 billion in savings over ten years. The Committee has the tax code within its jurisdiction, including about $1 trillion a year in tax expenditures, many of which are heavily weighted toward upper-income households. Yet it chose not to obtain any of its required savings by narrowing tax breaks, regardless of their merits. Instead, it found $68.2 billion in cuts — more than the required savings — exclusively from programs designed to help low-income, uninsured, and otherwise vulnerable people.

We’ll provide more analysis of the proposed House cuts next week.