BEYOND THE NUMBERS

Low-wage working families have less support in North Carolina as of January 1. That’s when the state officially eliminated its earned income tax credit (EITC), giving North Carolina the dubious distinction of being the only state ever to do so.

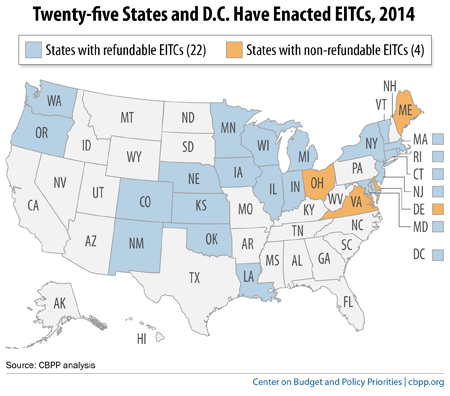

Half the states have created EITCs (see map) to help working families with incomes up to roughly $50,000 make ends meet. As our recently updated backgrounder explains, these credits build on the benefits of the federal EITC and are easy to administer, with nearly every dollar spent on state credits going directly to the working families they were created to help. They not only help families working for low wages meet basic needs but also reduce poverty, especially among children. And the benefits can be long-lasting: low-income children in families that get additional income through programs like the EITC do better and go farther in school and, as a result, work more and earn more as adults.

North Carolina’s decision to end its EITC will mean a tax hike for 900,000 working households, most of them with children to support. The state’s policymakers had already cut the credit for 2013, its last year on the books, from 5 percent of the federal credit to 4.5 percent, shrinking an already modest benefit.

North Carolina has made other tax and spending decisions lately that harm Tarheel families. The state raised sales taxes to partly fund deep income tax cuts for the wealthy, and it cut funding for schools and other state services. And North Carolina slashed unemployment benefits more deeply than any other state.

These actions not only harm individual families, they harm local businesses and slow the economy by taking dollars away from the consumers who are most likely to spend them on local goods and services.