BEYOND THE NUMBERS

This series has explained why we need to raise more revenue and why it makes sense to start at the top of the income scale. The budget from House Budget Committee Chairman Paul Ryan goes in exactly the opposite direction — it would cut taxes deeply at the top and raise even less revenue than if we continued all of President Bush’s tax cuts, leading to bigger deficits and worse income inequality.

The Ryan budget would permanently extend President Bush’s tax cuts, which policymakers enacted when the federal government had a large budget surplus and which have since proven unaffordable. That would cost more than $4 trillion over the first decade alone.

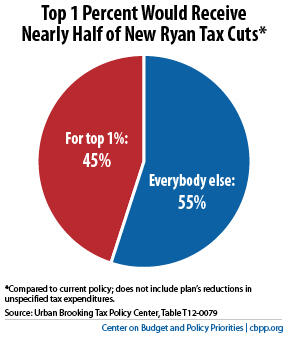

Next, Chairman Ryan would dig the budget hole even deeper with new tax cuts that would cost $4.5 trillion over the first decade (according to the Urban-Brookings Tax Policy Center); he has said he would pay for them by broadening the tax base but hasn’t offered any proposals. The tax cuts would overwhelmingly flow to the richest people in the country:

- People with incomes above $1 million would receive a $265,000 average annual tax cut, on top of the $129,000 they would receive from extending the Bush tax cuts. Their after-tax incomes would rise by 12.5 percent, on average — seven times more than the 1.8 percent average gain for middle-income households.

- The top 1 percent of taxpayers — those with incomes above $630,000 — would receive 45 percent of the new tax cuts, or nearly as much as the rest of the entire population (see graph).

- Low-income working families would actually be hit with tax increases because the Ryan plan wouldn’t fully extend President Obama’s tax cuts for working-poor households. People with incomes below $10,000 would see their after-tax incomes fall by 2 percent, on average.