BEYOND THE NUMBERS

Yesterday’s post in this series explained why the nation’s unsustainable budget deficits must be in the forefront of any tax reform discussions. That means we’ll need to raise enough additional revenue to contribute to a balanced deficit-reduction plan.

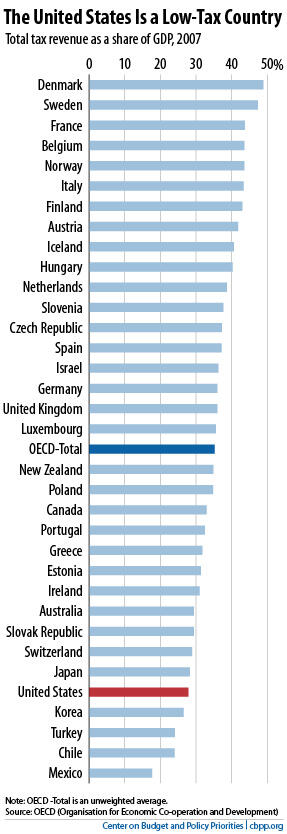

Fortunately, taxes are low right now, both historically and compared to other countries:

- Across the board, federal taxes are far lower than they were before the early 1980s, Congressional Budget Office (CBO) data show. For example, people in the middle 20 percent of the population paid 14.3 percent of their incomes in federal taxes in 2007 (the most recent year available), down from 18.6 percent in 1979. For the top 1 percent of households, the average federal tax rate fell from 37 percent to 29.5 percent over this period.

- As the chart shows, the United States is a low-tax country. Total U.S. tax revenue (including both the federal government and the states) is below all of the other wealthy “G-7” countries as a share of the economy. And it’s far below the average for members of the Organisation for Economic Co-operation and Development (OECD), which includes many less affluent countries (which tend to have lower taxes).

Moreover, higher taxes are not an inherent barrier to economic growth. CBO has found that tax increases used to reduce budget deficits can improve long-term economic growth and job creation. Claims that reasonable revenue increases will sink the economy largely reflect politics and ideology, not solid analysis — as the experience of the 1990s shows.

In short, the United States needs to raise more revenue and has room to do it.