BEYOND THE NUMBERS

Fifty years after Michael Harrington’s groundbreaking book, The Other America, shed light on widespread poverty in the United States, Demos, CBPP, and the Georgetown Center on Poverty, Inequality, and Public Policy will hold a conference next Tuesday where we’ll examine factors affecting poverty today and promising strategies for lifting and keeping Americans out of poverty.

With that anniversary in mind, we thought we’d take a look at the important role that public benefit programs have played in reducing poverty.

In his 1964 State of the Union, President Lyndon Johnson announced an “unconditional war on poverty in America.” That same year, Sargent Shriver, a key Johnson advisor on poverty issues, argued that we could set 1976 as “the target date for ending poverty in this land.”

We made enormous progress during those years. The poverty rate under the official measure of poverty, which counts only cash income, fell by half between 1959 and 1973, from 22 percent to 11 percent.

Despite these early and impressive successes, millions of Americans today live with incomes below the poverty line. A major reason why we didn’t make even more progress is that beginning in the mid-1970s, economic growth no longer meant rising incomes for everyone. That was a sharp change from the previous post-war years, in which a growing economy led to a roughly similar rate of growth in family incomes whether one was poor, middle class, or wealthy.

Research by economist Sheldon Danziger of the University of Michigan’s National Poverty Center indicates that if the relationship between economic growth and median earnings growth from 1959 to 1973 had continued in the years after 1973, official income poverty would have fallen to very low levels. It’s clear that the surge in income inequality was an important factor in impeding progress.

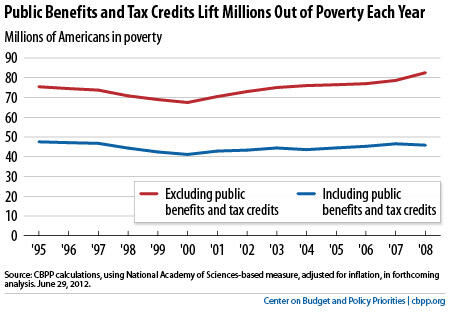

My colleague, Arloc Sherman, using a measure of poverty that is more comprehensive than the official measure and includes non-cash benefit programs and tax credits, finds that public benefits cut poverty nearly in half in 2010, despite the deepest recession in generations.

Widely shared economic prosperity is critical for poverty reduction, and the growth in income inequality is now placing added importance on public benefits and tax credits in keeping poverty from climbing still higher.