BEYOND THE NUMBERS

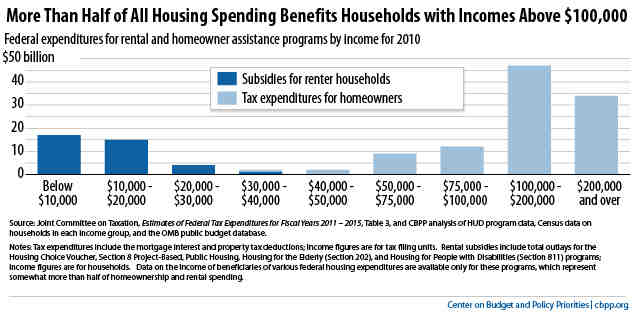

The nation’s housing policy is out of whack. We’ve focused for decades on policies to increase homeownership, and most federal housing dollars benefit families with relatively little need for assistance. When you count both direct spending and tax subsidies, about 75 percent of federal housing dollars support homeownership – though only two-thirds of households own homes. Overall, more than half of federal spending on housing benefits households with incomes above $100,000 (see chart).

Meanwhile, the nation’s lowest-income renters are far likelier to struggle to pay for housing– and their affordability problems are growing.

It’s time to rebalance the nation’s housing spending to help these low-income households.

A federal renters’ tax credit could take an important step in this direction, as we explain in a new paper. It would be administered by states, which would each receive a fixed dollar amount of credits and allocate them based on federal income eligibility rules and state policy preferences.

Such an approach would make it possible for more poor families to afford housing at a relatively modest overall cost. A renters’ credit capped at a total of $5 billion could:

- Assist about 1.2 million of the lowest-income renter households;

- Reduce each household’s rent by an average of $400;

- Cut the number of very low-income households paying more than half of their income for housing by about 700,000; and

- Lift 250,000 families out of poverty and lift four of five of the poorest families it assists out of deep poverty (defined as having income below half of the federal poverty guidelines).

It’s the right time to consider such a credit, as policymakers gear up for a potential tax reform debate, driven in part by deficit-reduction pressures and the scheduled expiration of President Bush’s income tax cuts at the end of 2012. That debate will likely consider how to restructure tax expenditures — a concept that policymakers in both parties appear to support.

Some heavy hitters have already started advocating for reforming homeownership tax deductions. The Bowles-Simpson and Rivlin-Domenici deficit reduction commissions and the Bush Administration’s Advisory Panel on Federal Tax Reform each proposed converting the mortgage interest deduction to a credit that would increase revenues and reach a broader share of low- and middle-income homeowners. And the Obama Administration, most recently in its 2013 budget, has proposed capping the value of the mortgage interest deduction and other itemized deductions for high-income taxpayers.

Those changes could make homeownership tax expenditures more efficient and raise added revenues to reduce the deficit. Directing a modest share of the savings to the renters’ credit could further improve the effectiveness and fairness of the nation’s housing spending.