BEYOND THE NUMBERS

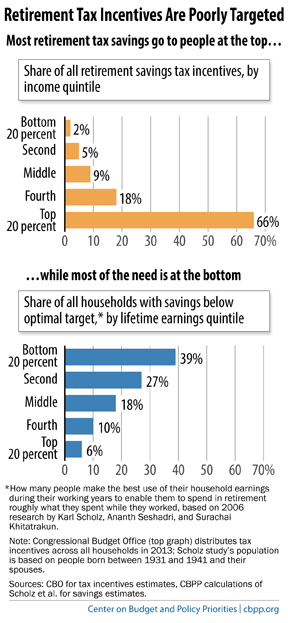

“We need to hear facts and serious policy proposals, not political slogans” like “upside-down tax incentives,” the Senate Finance Committee’s top Republican, Orrin Hatch, said at a recent committee hearing on retirement savings. But tax incentives for retirement plans like 401(k)s and individual retirement accounts (IRAs)are indeed “upside down,” providing the largest subsidies to high-income taxpayers while benefiting low-income households the least (see chart). As we’ve written, tax incentives for retirement savings are expensive, inefficient, and inequitable, making them ripe for reform.

New studies, including one highlighted at the September 16 Senate hearing, show how some very high-income taxpayers are accumulating enormousbalances using tax-preferred accounts — well beyond the accounts’ intended purposes. Roughly 9,000 taxpayers have IRAs with balances that top $5 million, a Government Accountability Office (GAO) study found. Despite contribution limits to tax-advantaged retirement accounts, such balances are possible because some executives buy shares of stock for their IRAs at extremely low valuations — sometimes less than a penny each. Those balances then swell when the stocks are valued at market price — and the gain is tax-free. Senate Finance Committee Chairman Ron Wyden (D-OR) termed this abuse of IRAs an unintentional “tax shelter for millionaires.”

The GAO study complements research published in the Journal of Retirement, which estimated that about 85,000 households each held over $3 million in certain tax-preferred plans, including IRAs.

Retirement savings tax incentives are among the largest federal category of “tax expenditures,” in terms of federal revenue losses. While lavishing large tax benefits on very wealthy filers, they do little to encourage new saving among a broad segment of lower- and middle-income Americans.

The need for reform is clear.