BEYOND THE NUMBERS

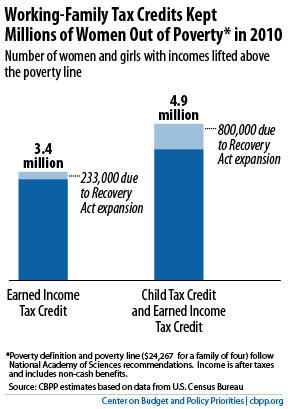

March is women’s history month and income taxes are due in April. So it’s a good time to note the difference that tax credits for working families, such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), make for women’s economic security.

The numbers rise when you include a second federal income tax credit — the less well-known CTC, which provides up to $1,000 per child for working families: together, the CTC and EITC kept 4.9 million women and girls above the poverty line in 2010, including more than 800,000 just by the Recovery Act’s expansions of both credits. (The Recovery Act expanded other benefits that kept women out of poverty, too. Counting just a few of them — the Making Work Pay Tax Credit, two expansions of unemployment benefits, and added food stamp benefits, in addition to the EITC and CTC improvements — the Recovery Act and subsequent extensions kept 3.5 million women and girls above the poverty line in 2010.)

Further, research suggests that the EITC may continue to improve these women’s economic security even after they retire. In a new Congressional Budget Office working paper, researchers project that by raising employment and earnings levels for working-age women, the EITC will boost their Social Security retirement benefits. That’s because your Social Security eligibility and benefit levels are based on your prior work and earnings history.

The vast majority of seniors rely heavily on Social Security benefits in retirement, but these benefits are especially critical for women and low-wage workers. That the EITC is expected to boost Social Security receipts and benefits among low-wage women is just one more way that it provides economic security by promoting and supporting work.