BEYOND THE NUMBERS

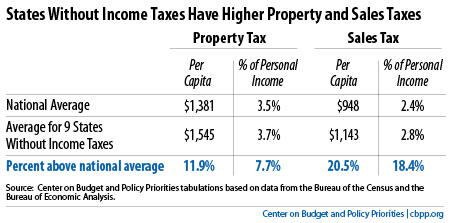

Kansas, Nebraska, and Oklahoma are considering sharply reducing their income taxes or phasing them out entirely. But there is no free lunch, as our analysis of the nine states without an income tax (AK, FL, NV, NH, SD, TN, TX, WA, WY) shows. Property taxes in these states are, on average, 8 percent or 12 percent above the national average, depending on how you measure them, and their sales taxes are 18 percent or 21 percent above the national average (see table).

In other words, residents of Kansas, Nebraska, and Oklahoma would have to pay for slashing their income taxes, one way or another. Right now, those three states’ property and sales taxes are lower than in most non-income-tax states, but that would likely change if they wipe out much or all of their income tax.

It’s not hard to figure out why property and sales taxes rise in the absence of an income tax. When faced with the dilemma of funding public services with substantially less tax revenue, lawmakers must find other resources to fill the gap. They might raise state sales taxes and other fees or shift spending obligations to localities, which in turn may raise property and/or sales taxes.

This is particularly bad for middle- and lower-income families, since they pay more in property and sales taxes as a share of their incomes than higher-income families do. In essence, states that do away with their income taxes shift more of the responsibility for paying for roads, schools, health care, and other services on to people less able to afford it.

Hikes in sales and property taxes would also affect farms and businesses, which would pay higher taxes on business purchases and on agricultural and commercial property.

Higher sales and property taxes aren’t the only price that residents of Kansas, Nebraska, and Oklahoma would likely pay for slashing their income taxes. Income taxes represent a large chunk of each state’s general fund tax revenue: 46 percent, 45 percent, and 35 percent, respectively. So these three states probably wouldn’t offset all of the lost income tax revenue with property and sales tax increases. This means that, even after years of cuts to public services due to the recession, investments that residents rely on will be back on the chopping block.