BEYOND THE NUMBERS

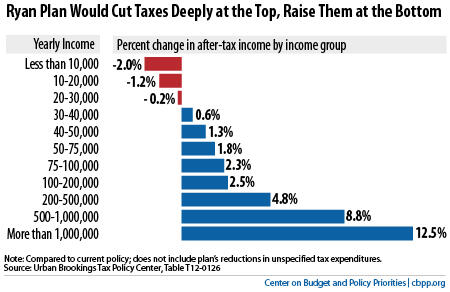

You’ve undoubtedly heard lots about how House Budget Committee Chairman Paul Ryan’s budget plan would give millionaires an average $265,000 apiece in new tax cuts, on top of the $129,000 apiece they would get from Ryan’s call to extend President Bush’s tax cuts. Have you also heard, however, that he wants to raise taxes for some other Americans? Want to guess who would bear the brunt of his tax hikes?

The Urban-Brookings Tax Policy Center has published new numbers that show the Ryan plan would raise taxes on low-income working families — those making up to $30,000 a year. That’s because, while he would extend the Bush tax cuts, which are due to expire at the end of this year, he would not extend President Obama’s tax cuts for those with the lowest incomes, which will expire at the same time. Our updated report gives the details.

Chairman Ryan’s proposed tax hikes on low-income Americans would come even as, on the spending side, his budget would slash programs that assist this same population.

Specifically, people with incomes below $10,000 would see their after-tax incomes fall by 2 percent, on average. But people with incomes above $1 million would see their incomes rise by 12.5 percent (see graph).

While making permanent the Bush tax cuts, which disproportionately benefit people at the top of the income scale, Chairman Ryan also would cut marginal tax rates even below the Bush levels. In fact, his plan would drop the rate for very wealthy individuals to its lowest level since Herbert Hoover’s presidency.

Chairman Ryan says his plan would fully offset the cost of his proposed tax cuts by closing tax expenditures (tax credits, deductions, and other preferences) for high-income households. But he hasn’t said what tax expenditures he would cut.

By raising taxes on low-income Americans and cutting programs that help them, while giving high-income people large tax cuts, the Ryan budget would significantly worsen inequality and reduce opportunity.

Here’s some of what would happen:

A single mother with two kids struggling to make ends meet by working full-time at the minimum wage would lose $1,500 (over 80 percent) of her child tax credit; she could lose some or all of her food stamps as well. Meanwhile, Pell Grants, which help students from poor families attend college, would also face cuts, making it harder for striving low-income children to make it into the middle class.