BEYOND THE NUMBERS

Update, April 10: This blog post has been updated. Click here for the full analysis of the cuts to programs serving people with low or moderate incomes in Chairman Ryan’s budget.

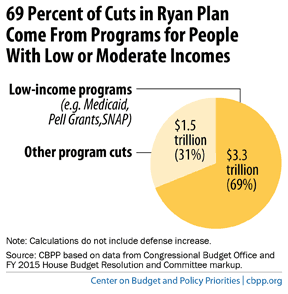

Some 69 percent of the cuts in House Budget Committee Chairman Paul Ryan’s new budget would come from programs that serve people of limited means, our forthcoming report finds. These disproportionate cuts — which likely account for at least $3.3 trillion of the budget’s $4.8 trillion in non-defense cuts over the next decade — contrast sharply with the budget’s rhetoric about helping the poor and promoting opportunity.

The low-income cuts fall into five categories:

- Health coverage. The Ryan budget has at least $2.7 trillion in cuts to Medicaid and subsidies to help low- and moderate-income people buy private insurance. Under the Ryan plan, at least 40 million low- and moderate-income people — that’s 1 in 8 Americans — would become uninsured by 2024.Image

- Food assistance. The Ryan budget cuts SNAP (formerly food stamps) by $137 billion over the next decade. It adopts the harsh SNAP cuts that the House passed last September — which would force 3.8 million people off the program in 2014, according to the Congressional Budget Office — and then converts SNAP to a block grant in 2019 and imposes still-deeper cuts.

- Help affording college. The Ryan budget cuts Pell Grants for low- and moderate-income students by up to $125 billion through such means as freezing the maximum grant (which already covers less than a third of college costs) for ten years, cutting eligibility in various ways, and repealing all mandatory funding for Pell Grants.

- Other mandatory programs serving low-income Americans. The Ryan budget cuts an additional $385 billion — beyond its SNAP cuts —from the budget category containing many mandatory programs for low- and moderate-income Americans, such as Supplemental Security Income for the elderly and disabled, the school lunch and child nutrition programs, and the Earned Income and Child Tax Credits for lower-income working families. We estimate that at least $250 billion of these cuts would fall on such low-income programs, as explained in the final paragraph of this blog.

- Low-income discretionary programs. The Ryan budget cuts these programs by about $250 billion, on top of the cuts already enacted through the 2011 Budget Control Act’s discretionary caps and sequestration.

Our estimates are likely conservative. In cases where the Ryan budget cuts funding in a budget category but doesn’t distribute that cut among specific programs — such as its cuts in non-defense discretionary programs and its unspecified cuts in mandatory programs — we assume that all programs in that category, including programs not designed to assist low-income households, will be cut by the same percentage.