BEYOND THE NUMBERS

Proponents of permanently repealing the estate tax often propagate various myths about it, but Rep. Kevin Brady (R-TX), who chairs the Joint Economic Committee and is a senior member of the House Ways and Means Committee, went a step further last week. In introducing legislation to repeal the estate tax, Brady stated, “What kind of government swoops in upon your death and takes nearly half of the nest egg you’ve spent your entire life building?”

Well, not the U.S. government — not even close. Rep. Brady’s characterization of the tax, highlighted in a news release he issued June 19 with Senate Finance Committee member John Thune (R-SD), the bill’s Senate sponsor, is not only flatly wrong. It’s also highly irresponsible, in that it comes from such a senior member of two relevant congressional committees who should know the basic facts about the tax he’s proposing to abolish, at considerable cost to the Treasury.

The truth is this: only a tiny sliver of estates pay any tax at all, and the very wealthy ones that do so pay at a rate that’s far less than half. Repealing the estate tax would amount to a massive windfall for the inheritances of the wealthiest Americans.

- Only the richest 0.14 percent of estates pays any estate tax at all. Only the estates of the wealthiest 0.14 percent of Americans — fewer than 2 out of every 1,000 people who die — now owe any estate tax whatsoever, according to the Urban-Brookings Tax Policy Center (TPC), because the tax is levied only on the portion of an estate’s value that exceeds $5.25 million per person (effectively $10.5 million per married couple).

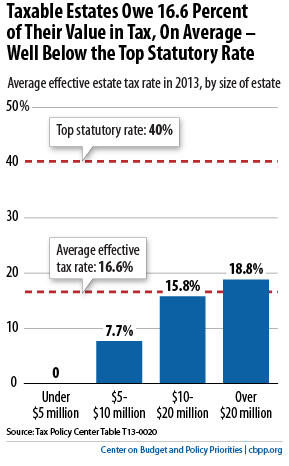

- Those paying the estate tax generally pay less than one-sixth of the value of the estate in tax, a far cry from Brady’s claim that nearly half of estates are taxed away. As noted, 99.86 percent of estates owe no estate tax at all. TPC reports that among the 3,780 estates that owe any tax this year, the “effective” tax rate — that is, the percentage of the estate’s value that is paid in tax — is 16.6 percent, on average. The 16.6 percent rate is far below the top statutory tax rate of 40 percent because taxes are due only on the portion of an estate’s value that exceeds the $5.25 million per-person exemption level and because heirs can often shield a large portion of an estate’s remaining value from taxation through various deductions.

- Large estates consist of a large amount of “unrealized” capital gains that have never been taxed. The estate tax serves in part as a “backstop” to the capital gains tax. Usually, capital gains are taxed when an asset is sold or disposed of and the gain is “realized.” But if a person holds an asset that mounts in value until his or her death, this “unrealized” capital gain is exempt from the capital gains tax. Research shows over half of the assets in large estates — those that contain more than $10 million in assets — has never been taxed. Without the estate tax, those unrealized gains would escape taxation entirely.