BEYOND THE NUMBERS

Reality Check on Who Pays Taxes

With the issue of who pays federal income taxes back in the news, here’s a post we did on this subject in April. It’s based on this CBPP analysis, which relies in large part on data from the Urban-Brookings Tax Policy Center:

Have you heard that close to half of U.S. households currently don’t owe federal income tax? Does that mean, as some policymakers and pundits claim, that low- and moderate-income families don’t pay taxes, or don’t pay enough of them? Not at all, as our updated analysis of this widely misunderstood issue explains.

Here are some of its key points:

- The oft-cited figure that 51 percent of households didn’t pay federal income tax in 2009 is a temporary spike caused by the recession. In 2007, before the economy turned down, 40 percent of households did not owe federal income tax.

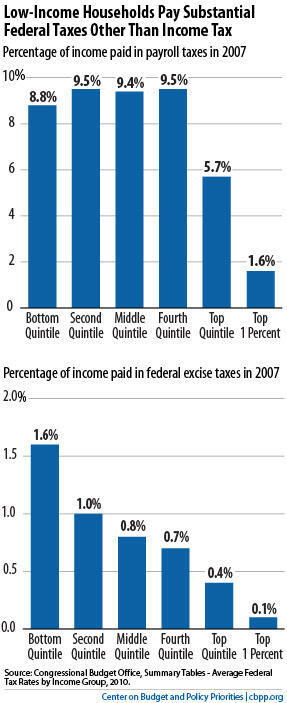

- These figures cover only the federal income tax and ignore the substantial amounts of other federal taxes — especially the payroll tax — that many of these households pay (see graphs at right). Some 82 percent of working households pay more in payroll taxes than in federal income taxes. In fact, low- and moderate-income people pay a much larger share of their incomes in federal payroll taxes than high-income people do.

- Most of the people who pay neither federal income tax nor payroll taxes are low-income people who are elderly, unable to work due to a serious disability, or students, most of whom subsequently become taxpayers.

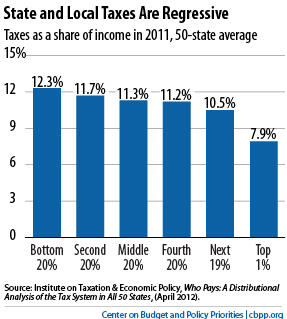

- Low-income households also pay substantial state and local taxes. Most state and local taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do (see graph below).

- When all federal, state, and local taxes are taken into account, the bottom fifth of households pays about 16 percent of their incomes in taxes, on average. The second-poorest fifth pays about 21 percent.

The fact that most people who don’t owe federal income tax in a given year do pay substantial amounts of other taxes — and also are net income taxpayers over time — belies the claim that households that do not owe income tax in a given year will form bad policy judgments because they “don’t have any skin in the game.”

Furthermore, although the federal tax system is progressive overall, state and local tax systems are regressive and undo a significant share of that progressivity. There is nothing wrong with having one part of the overall tax system shield low- and moderate-income households, who pay substantial amounts of other taxes and generally pay federal income tax as well in other years.

Click here for the full report.