off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

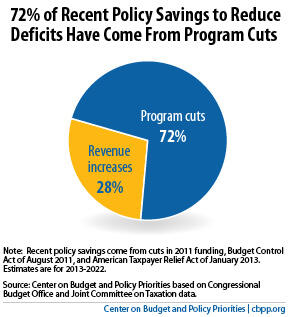

Program Cuts Far Outweigh Tax Increases in Deficit Reduction to Date

Receive the latest news and reports from the Center

President Obama and Congress have enacted roughly $2 trillion of policy savings (tax increases and spending cuts) over the past few years to help reduce budget deficits, our recent report points out, and 72 percent of them have come through program cuts — most notably, those in the 2011 Budget Control Act (see graph).

Our paper also explains that:

even if the additional savings were divided evenly between revenue increases and program cuts, the total deficit reduction under the three deficit-reduction packages would be heavily weighted toward budget cuts: 64 percent budget cuts to 36 percent revenue increases, or a ratio of nearly 2 to 1. To achieve a 50-50 split for the combined deficit-reduction packages, policymakers would have to obtain nearly 90 percent of the additional $1.2 trillion in savings from revenue increases.

In contrast, if all of the additional savings were to come from program cuts, as Republican congressional leaders have suggested, the overall ratio would be still more skewed, with more than four-fifths coming on the spending side — a ratio of nearly 5 to 1.