BEYOND THE NUMBERS

As Georgetown University’s Peter Edelman explained in yesterday’s New York Times, the serious hurdles that this nation faces in ending poverty shouldn’t obscure our real achievements in this area over recent decades. He cites a CBPP estimate that poverty would be nearly double what it is now if not for programs like the Earned Income Tax Credit and SNAP (formerly food stamps).

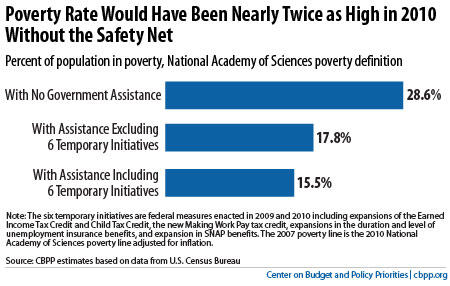

Here are the specifics, as we outlined them last fall:

[S]ix recession-fighting initiatives enacted in 2009 and 2010 kept nearly 7 million people out of poverty in 2010 — under an alternative measure of poverty that takes into account the impact of government benefit programs and taxes. . . .

[I]f the government safety net as a whole — these temporary initiatives (all were featured in the 2009 Recovery Act) plus safety-net policies already in place when the recession hit — hadn’t existed in 2010, the poverty rate would have been 28.6 percent, nearly twice the actual 15.5 percent (see graph).

This shows the powerful anti-poverty impact of policies ranging from tax credits like the Earned Income Tax Credit and Child Tax Credit to unemployment insurance, SNAP (food stamps), Social Security, Supplemental Security Income, veterans’ benefits, housing assistance, and others.