BEYOND THE NUMBERS

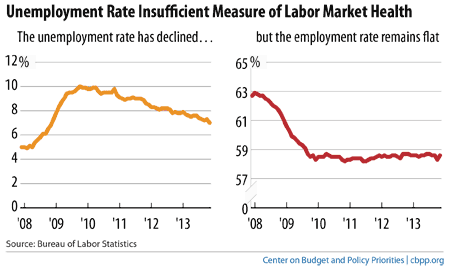

November’s drop in unemployment to 7.0 percent was obviously welcome, but policymakers should not conclude that they can now justifiably let federal emergency unemployment insurance (UI) expire at the end of this year. That’s because a look only at the unemployment rate provides too optimistic a picture of the overall health of the labor market.

As I explained last week in my statement on November’s jobs report, labor market conditions are significantly better than in the depths of the Great Recession in 2008-2009, but they remain far from what they should be. In a robust jobs recovery, the unemployment rate falls quickly and the share of the population with a job (the employment-population ratio, or employment rate) rises. Not this time, as the chart shows.

The share of the population with a job, which plunged in the recession to levels last seen in the 1980s, has changed little in the ensuing four years. The chart shows the employment rate for the population aged 16 and older, but a chart for just 25- to 54-year-olds in their prime working years would not look much better.

The recession drove many people out of the labor force, and lack of job opportunities in the ongoing jobs slump has kept many potential jobseekers on the sidelines. Many of these people would like to work and, in a stronger labor market, they would likely have a job or at least be looking, but they are not looking actively enough to be counted as officially unemployed. Their absence from the ranks of the officially unemployed keeps the unemployment rate lower than it otherwise would be.

The latest jobs report makes the point perfectly. In November, labor force participation and employment surged and unemployment plunged. But most of that progress merely reversed the government shutdown’s adverse impact on the October numbers. Between September and November, the number of officially unemployed Americans fell by 348,000 but the number of people with a job rose by only 83,000. The difference was a decline in the labor force of 265,000. In other words, three-quarters of the drop in unemployment occurred through labor force shrinkage rather than employment growth.

That’s been the pattern since the recession officially ended in mid-2009. Declining labor force participation (to rates last seen in 1978) has offset declining unemployment and kept the share of the population with a job from rebounding.

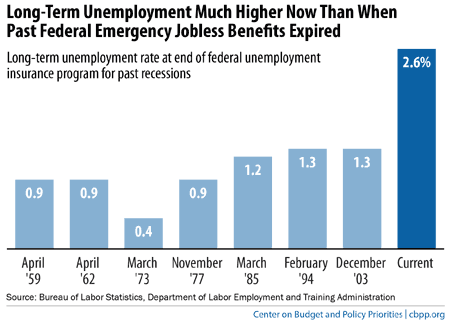

Jobs are hard to find and long-term unemployment remains a significant concern. Nearly two-fifths (37.3 percent) of the 10.9 million people who are unemployed — 4.1 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 2.6 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

At 2.6 percent, the long-term unemployment rate is at least twice as high as when any of the emergency federal UI programs that policymakers enacted in each of the previous seven major recessions expired (see chart).

Simply put, it’s too soon to let emergency UI benefits expire.