BEYOND THE NUMBERS

Senator Pat Toomey (R-PA) this week outlined what he described as a compromise deficit-reduction proposal that includes significant revenues. The reality is very nearly the opposite.

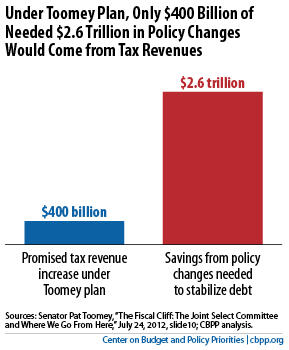

The Toomey proposal includes only modest revenues, and it then effectively takes revenues off the table for future rounds of deficit reduction. Future rounds would be needed because the Toomey plan doesn’t reduce deficits nearly enough to keep the debt from rising faster than the economy in the coming decade. Nearly all subsequent deficit reduction would therefore have to come from spending cuts (see graph).

- The plan falls well short of what’s needed to put the budget on a sustainable path. Analysts generally agree that we must reduce deficits by roughly $3 trillion over the next decade (about $2.6 trillion in policy changes plus $400 billion in interest savings) to stabilize the debt as a share of the economy. Senator Toomey estimates that his plan would cut deficits by $1.45 trillion — about half the needed amount.

- The plan “uses up” the two biggest potential revenue sources for deficit reduction — the Bush tax cuts and tax expenditures — while raising revenues only a very modest amount. Policymakers would have to rely overwhelmingly on spending cuts to get the rest of the way to the $2.6 trillion policy-change target.

Here’s why. By lowering tax rates well below the Bush levels and locking in the new tax rates permanently, the Toomey plan would make it impossible to secure $800 billion in deficit reduction by letting the Bush tax cuts for households with incomes over $250,000 expire at the end of 2012. The plan also would remove the leverage that the scheduled expiration of these tax cuts gives policymakers seeking a balanced deficit package that includes significant revenues.

Moreover, by making very substantial changes in tax expenditures (and using most of the resulting savings to pay for the reduction in tax rates), the plan would make it almost impossible to come back in the next few years and secure further substantial savings in tax expenditures. As a result, the avenues for securing a significant revenue contribution to deficit reduction would be closed off for the foreseeable future, despite the fact that a need for large additional deficit reduction would remain.

- Claims that the plan is balanced don’t hold up to scrutiny. Senator Toomey claims that his plan’s mix of spending cuts and tax increases is similar to that of the Bowles-Simpson plan. That is far from the case. If you examine Bowles-Simpson from the same starting point that Senator Toomey uses for his plan — namely, a baseline that assumes that all of the Bush tax cuts have been made permanent — then Bowles-Simpson raised well over $2 trillion in revenues over the next decade. The Toomey plan raises $400 billion. (Senator Toomey claims $500 billion, but that figure counts $100 billion in user fee increases and other savings of the sort that the federal budget — and Bowles-Simpson — properly classify as spending cuts.)

Senator Toomey also ignores the fact that Congress has already enacted $1.6 trillion in spending cuts since Bowles-Simpson was issued, primarily through the caps on discretionary spending enacted last summer in the Budget Control Act and the additional cuts in appropriations enacted earlier in 2011. If you add those spending cuts to the additional cuts that the Toomey plan would effectively require, the overall distribution of spending cuts and tax increases since Bowles-Simpson would become even more lopsided.

- The proposed dollar cap on itemized deductions is a potential step forward. One aspect of Senator Toomey’s plan — his proposal to place a dollar cap on itemized deductions — represents an advance over some other proposals to impose a limit on the overall benefits that tax expenditures can provide to a taxpayer. It is more specific, could raise significant revenue, and could do so in a progressive manner.

The Toomey tax-expenditure proposal raises some concerns, however. Past bipartisan proposals to lower the top income-tax rates below 30 percent, such as the Tax Reform Act of 1986 (championed by Ronald Reagan) and the Bowles-Simpson plan, tied such a reduction in tax rates to the elimination of lower tax rates on capital gains income. The Toomey plan, by contrast, keeps the top capital gains tax rate at 15 percent. In addition, it would make permanent the estate-tax giveaway enacted on a temporary basis as part of the 2010 tax-cut deal, which slashes estate-tax obligations for the estates of the wealthiest 3 of every 1,000 Americans who die.

The specifics of the Toomey tax-deduction proposal would also need to be analyzed carefully to ascertain their impacts on the ability of state governments to raise adequate revenues, as well as on charitable contributions.

The principal shortcoming of this aspect of the plan, however, is that as noted above, Senator Toomey would use the overwhelming share of the revenue from his tax-expenditure proposal to pay for across-the-board tax rate cuts. This ignores what should be the primary task at hand — reducing unsustainable budget deficits and contributing to a balanced package that achieves that goal.