BEYOND THE NUMBERS

More than 80 percent of households earning under $15,000 a year — roughly equivalent to full-time work at the minimum wage — paid more than 30 percent of their income for housing in 2012, a new report by Harvard’s Joint Center for Housing Studies finds. The federal government and many private-sector landlords and lenders consider housing unaffordable if it exceeds 30 percent of household income.

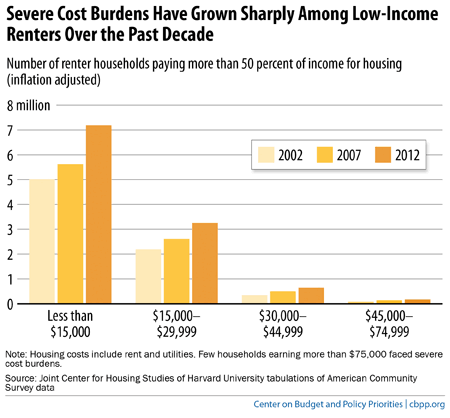

The shortage of affordable housing, which is hitting the lowest-income families the hardest, seems to be growing worse. The number of households earning under $15,000 paying more than half of their income for housing jumped by over 2 million from 2002 to 2012 (see chart). In fact, in that latter year, 69 percent of households earning under $15,000 paid more than half of their income for housing.

The report documents a growing “crisis of affordability” for renters, driven by a widening gap between rental costs and renter incomes. The gap began growing well before 2007 but worsened during the Great Recession. The median renter income plummeted 13 percent between 2001 and 2012, while median rents rose 4 percent.

Federal policymakers have made things worse by cutting rental assistance. For example, the number of families using Housing Choice Vouchers, the most common form of federal rental assistance, fell by more than 70,000 in 2013 due to across-the-board sequestration cuts. Congress provided funds to restore up to half of these vouchers in 2014, but the 2015 spending bills that the House and Senate appropriations committees have approved for the Department of Housing and Urban Development don’t renew all of those vouchers and risk locking in the full sequestration cuts.

Some 5 million low-income households receive federal rental assistance, mostly working families with children, seniors, and people with disabilities. Studies show that vouchers and other types of rental assistance are extremely effective at reducing poverty, homelessness and housing instability. With a stable home — the foundation necessary for families to thrive —becoming unaffordable for more Americans, policymakers should be strengthening these programs, not cutting them.