BEYOND THE NUMBERS

Long-Term Budget Outlook Challenging But Manageable, New CBO Report Confirms

The Congressional Budget Office’s (CBO) new long-term budget projections show that putting the budget on a sustainable long-term course remains challenging but is significantly more manageable than in previous projections.

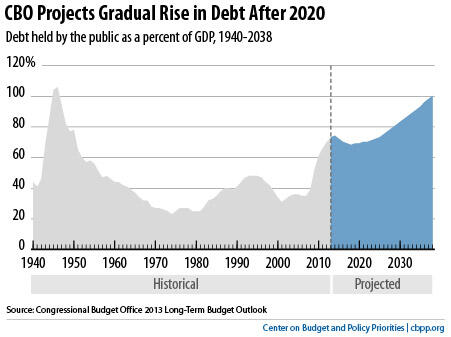

Under current law, the federal debt will edge down as a percentage of the economy during the rest of this decade but then resume a gradual rise, CBO projects. The ratio of debt to gross domestic product (GDP) — projected to be 73 percent at the end of 2013 — will drop to 68 percent in 2018 but climb to 100 percent by 2038. (See graph.)

Although differing in some details, CBO’s new projections join a growing consensus about the long-term outlook. CBPP recently estimated that the debt-to-GDP ratio in 2040 would be 99 percent; the Committee for a Responsible Federal Budget predicts a ratio of 108 percent that year; the Center for American Progress estimates between 97 and 112 percent.

In short, analysts who’ve looked carefully at the numbers see a gradually rising — but hardly explosive — trend under current policies.

CBO’s new long-term baseline projection is much more favorable than its oft-cited “alternative fiscal scenario” of June 2012, which not only assumed that lawmakers would extend all of the tax cuts lapsing at the end of 2012 but also diverged from current budget policy in several other significant ways. In fact, Congress allowed those tax cuts to expire for some of the richest Americans. And we’ve seen continued good news on the health-spending front. Those changes and other updates mean that CBO’s new extended baseline projection paints a more accurate picture of the budget outlook than the June 2012 alternative scenario.

CBO’s new report also shows that we can stabilize the debt without deep program cuts or sharp tax increases. Getting the debt ratio back down to today’s level by 2038 would require paring non-interest spending by about 4 ½ percent, raising taxes by about 4 ½ percent, or some combination, says CBO. That’s ambitious but attainable.

The deficit has already fallen by half from its peaks in 2009-2011. That’s more than enough austerity for now. CBO’s analysis confirms that Congress should take thoughtful action to stabilize the nation’s finances without jeopardizing the economic recovery.