BEYOND THE NUMBERS

We strongly agree with today’s Washington Post editorial that calls on policymakers to let the “bonus depreciation” tax break, which they extended for a year in the recent “tax extenders” package, expire next year.

Bonus depreciation lets businesses take bigger upfront deductions for certain purchases such as machinery and equipment. As our report explains, Congress enacted it on a temporary basis in 2008 to bolster the economy during the Great Recession, not to make it a permanent part of the tax code or extend it year after year.

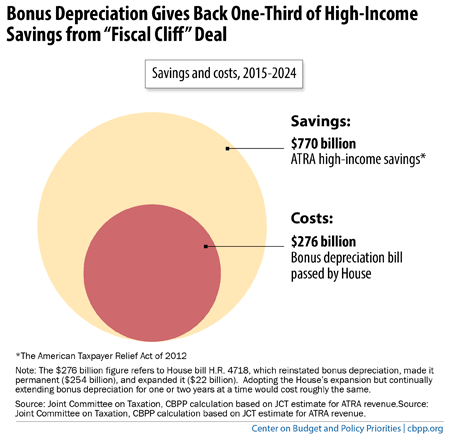

The House, however, voted earlier this year to expand bonus depreciation and extend it permanently at a cost of $276 billion over ten years — enough to wipe out one-third of the revenue raised by the high-income revenue provisions of the 2012 “fiscal cliff” legislation. (See graph.)

Permanent bonus depreciation wouldn’t just be fiscally irresponsible. It would also be economically unjustified. As the Post points out:

[S]everal economic studies have shown that, in practice, bonus depreciation is “not very effective” as a boost to economic growth, in the words of a recent Congressional Research Service report — and probably less effective than other tax cuts or spending increases that have since expired. Tax break or no, many firms won’t invest at times of weak demand for their products; in any case, bonus depreciation affects only one incentive in what, for many companies, may be a highly complex tax-planning scenario.

Whatever stimulative effect bonus depreciation has, though, depends on its being both temporary and timely — i.e., that companies understand it will be available during recessions and only then. Extending the measure now amounts to a gratuitous handout; indeed, it’s been decreasingly necessary ever since the “Great Recession” officially ended in June 2009. Since the proposed one-year extension, which would cost $5 billion, is retroactive, it actually amounts to a windfall benefit for investment decisions corporations have already made.

In short, bonus depreciation provides only modest benefit as a temporary stimulus measure and none at all as a de facto permanent part of the code. . . .