off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Just the Basics: Where Our Federal Tax Dollars Go

Receive the latest news and reports from the Center

As Tax Day approaches, we’ve updated several backgrounders that explain how the federal government and states collect and spend our tax dollars. As policymakers and citizens weigh key decisions on how best to shape our future federal government, it’s helpful to examine where the dollars that comprise the budget come from and where they go.

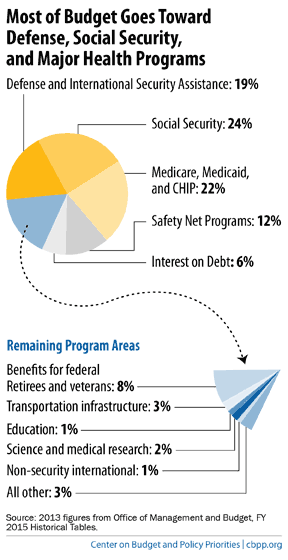

As the chart shows, three major areas of spending each make up about one-fifth of the budget: defense and international security assistance; Social Security; and Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP).

Together, two other categories account for another fifth of spending: the first is safety net programs, including critical programs like unemployment insurance and SNAP (formerly known as food stamps), which protect people through difficult financial times, and the refundable portion of the Earned Income Tax Credit and the Child Tax Credit, which lift millions of people out of poverty each year; and the second is interest on the national debt. The remaining fifth supports a variety of other public services (see chart).

Click here to read the full paper, which gives more detail about what’s in each of these categories of spending.