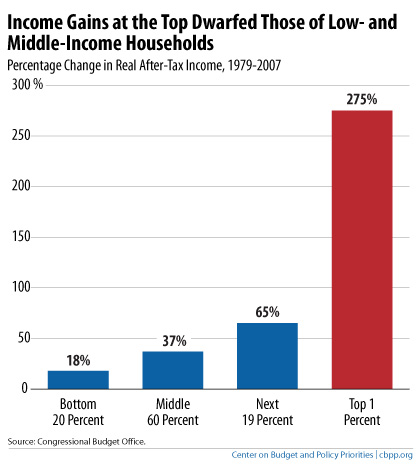

The Congressional Budget Office has released a fascinating and disturbing analysis on the growth in income inequality among American households over the past few decades. The key findings are:

- Inequality increased significantly over this period (see graph). Between 1979 and 2007, incomes grew by 275 percent for the wealthiest 1 percent of households, 37 percent for the middle 60 percent of households, and 18 percent for the poorest 20 percent of households. These figures adjust for inflation and account for the impact of taxes and government transfer payments such as Social Security and unemployment benefits.

- The share of the nation’s total income accruing to the middle 60 percent of households fell from around half in 1979 to a bit above 40 percent in 2007. Virtually all of this decline (and the decline in the share of income held by the bottom 20 percent of households) is reflected in the increase for the top 1 percent, whose share of the nation’s total income more than doubled.

The increase in inequality mostly reflects the growing share of market income — that is, income before accounting for taxes and transfer payments — going to higher-income Americans. Because our tax and transfer system is progressive (e.g., higher-income households pay higher federal income taxes and transfers tend to benefit those with lower incomes), taxes and transfers reduce inequality at any given point in time.

The increase in inequality mostly reflects the growing share of market income — that is, income before accounting for taxes and transfer payments — going to higher-income Americans. Because our tax and transfer system is progressive (e.g., higher-income households pay higher federal income taxes and transfers tend to benefit those with lower incomes), taxes and transfers reduce inequality at any given point in time.

But, given that market incomes have grown more unequal, a good question is whether changes to the tax and transfer system in recent decades have made it more effective in pushing back against this rising tide of inequality. They haven’t. In fact, the opposite has happened. The CBO study finds: “Between 1979 and 2007, the Gini index [a measure of income inequality] for market income increased by 23 percent … and the index for income measured after transfers and federal taxes increased by 33 percent.”

The reason is that both federal taxes and transfers, while still progressive, have become less so over time. In a sense, the tides of inequality have been rising, while the levees to hold them back have been shrinking.