BEYOND THE NUMBERS

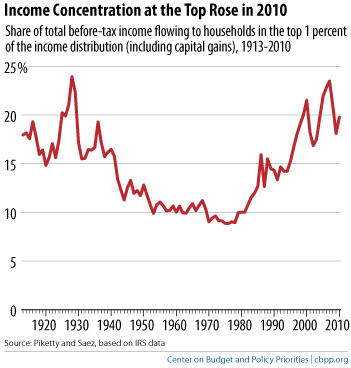

The share of the nation’s total income going to the top 1 percent of households, which fell in the financial crisis and Great Recession, rose in 2010, the first full year of the economic recovery, according to the latest update to the historical series compiled by economists Thomas Piketty and Emmanuel Saez.

If the experience following the dot-com collapse a decade ago is any guide, incomes at the top may well continue to grow in the coming years.

As we discuss in our guide to statistics on income inequality, the Piketty-Saez data provide an invaluable long historical series of annual data on income at the top of the distribution, although Congressional Budget Office (CBO) data provide a better estimate of growth in the bottom 90 percent. CBO data, however, are not available on as timely a basis and only go back to 1979.

The Piketty-Saez data paint a clear picture of faster income growth and rising income concentration at the top over the past few decades. The dot-com collapse proved to be nothing more than a speed bump, and the financial crisis and Great Recession may turn out to have had similarly transitory effects. As Saez says in the new report:

Looking further ahead, based on the US historical record, falls in income concentration due to economic downturns are temporary unless drastic regulation and tax policy changes are implemented and prevent income concentration from bouncing back. Such policy changes took place after the Great Depression during the New Deal and permanently reduced income concentration until the 1970s. In contrast, recent downturns, such as the 2001 recession, led to only very temporary drops in income concentration.

You can see a slideshow on income inequality here.