BEYOND THE NUMBERS

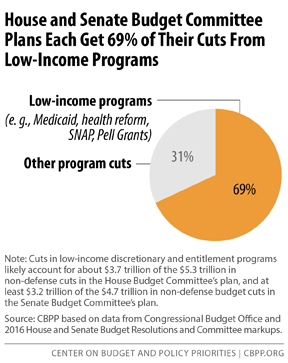

The 2016 budget resolutions that the House and Senate will consider this week each cut more than $3 trillion over ten years (2016-2025) from programs that serve people of limited means — representing 69 percent of their cuts to non-defense spending, as we explain in a new analysis (see chart).

The plans are strikingly imbalanced. While 69 percent of their cuts come from programs for people with low or modest incomes, these programs constitute less than 25 percent of federal program costs. Moreover, spending on these programs is already scheduled to fall as a share of the economy between now and 2025.

Among the programs that the plans would cut:

- Health care for low- and moderate-income people. Each plan would repeal health reform, including its subsidies to make coverage affordable for people with low or moderate incomes and its Medicaid expansion, and block-grant much of Medicaid, while also making deep cuts to the program. These cuts would make tens of millions of people uninsured or underinsured.

- SNAP (formerly food stamps). The House plan block-grants SNAP starting in 2021 and cuts SNAP funds by $125 billion, or more than a third, over 2021 to 2025. Cuts of this magnitude would end food assistance for millions of low-income families, cut benefits for millions of such households, or do some combination of the two.

- Tax credits for low- and modest-income working families. Each plan would let critical provisions of the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) expire at the end of 2017, which would push more than 16 million people, including almost 8 million children, into or deeper into poverty.

- Other mandatory (i.e. entitlement) programs serving low-income Americans. The House and Senate plans would each cut hundreds of billions of dollars from mandatory programs in the education and income security categories of the budget. Although each plan lacks specifics, severe cuts would occur to Pell Grants, which help students from families with modest incomes afford college.

- Low-income non-defense discretionary programs. The House and Senate plans each would make additional cuts on top of the significant reductions required by the Budget Control Act’s discretionary caps and sequestration. These cuts would shrink the funds available for investments in education, research, and transportation, as well as for low-income programs such as housing assistance, Head Start, and the Low Income Home Energy Assistance Program.

Our assumptions regarding the size of the low-income cuts are conservative. Where the plan leaves budget cuts unspecified, we assume that all programs in an affected program category would face the same percentage cut, even though some of the programs not targeted only on low- and moderate-income people, such as military retirement programs, would likely be cut significantly less than their equal share, if at all.

Click here to read the full report.