BEYOND THE NUMBERS

Today’s Supreme Court decision essentially means that states can decide whether or not to expand their Medicaid programs to cover low-income adults. The typical (or median) state only covers working parents who make less than 63 percent of the poverty line ($12,790 a year for a family of three) and non-working parents with incomes below 37 percent of the poverty line ($7,063 a year). Only a handful of states provide coverage to any low-income adults without dependent children, regardless of how far below the poverty line they fall. The Medicaid expansion in the Affordable Care Act would cover these poor and low-income adults by expanding Medicaid to 133 percent of the poverty line ($25,390 for a family of three). CBO assumed an additional 17 million adults would receive Medicaid coverage by 2022, as a result.

The Medicaid expansion is a very good deal for states:

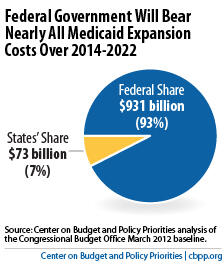

- The Congressional Budget Office estimates (assuming all states implement the expansion) that the federal government will bear nearly 93 percent of the costs of the Medicaid expansion over its first nine years.Image

- The additional cost to the states represents only a 2.8 percent increase in what states would have spent on Medicaid from 2014 to 2022 in the absence of health reform.

- Moreover, this 2.8 percent figure overstates the net impact on state budgets because it does not reflect the savings that state and local governments will realize in health-care costs for the uninsured.

Because the expansion is such a good deal for states, they should move forward and cover low-income adults in their states. But what happens in states that do not go ahead and provide coverage? The poorest adults — primarily parents and other adults working for low wages — will be left out in the cold.

In crafting the Affordable Care Act, Congress assumed that adults with incomes below the poverty line would be eligible for Medicaid. Therefore, Congress set the income range for eligibility for premium tax credits (i.e., for subsidies) to help purchase coverage in the new insurance exchanges at 100 to 400 percent of the poverty line. If a state decides not to implement the Medicaid expansion, poor adults in the state would not be eligible for the premium tax credits — and they would remain uninsured.

The biggest burdens in such cases would fall on low-income adults, who would lose the promise of coverage even while people with somewhat higher incomes will be eligible for premium tax credits. Hospitals and other health care providers would also lose out, as they lose the promise of Medicaid payment for services that currently are not reimbursed.