BEYOND THE NUMBERS

Examining the President’s New Tax Proposals

We’ve issued two pieces on the President’s new proposals, which he’ll discuss in tonight’s State of the Union address, to reduce the tax code’s tilt toward capital gains and use the new revenues to support work and help working families build skills and savings.

- Robert Greenstein’s statement:

In recent decades, economic growth has powerfully benefitted Wall Street, while leaving much of Main Street behind. The plan that President Obama unveiled today would take large, important steps to help redress part of the imbalance and make prosperity more broadly shared. The President’s new tax proposals will surely elicit howls of protest from various special interests and on ideological grounds; adversaries will make predictable claims that the proposals would harm the economy and jobs. Yet while the proposals do present a major challenge to the status quo, they should benefit economic growth, not hinder it, while substantially helping tens of millions of middle- and lower-income working families and individuals. . . .

- Our analysis of the capital gains proposals:

The tax code strongly favors income from capital gains — increases in the value of assets, such as stocks — over income from wages and salaries. These preferences are economically inefficient: they promote tax schemes that convert ordinary income into capital gains and encourage people to hold assets just to escape tax, even if they have better investment opportunities. They are also highly regressive, since capital gains are heavily concentrated at the top of the income scale. The President has proposed to make the tax code more efficient and equitable by reducing one of the biggest subsidies for capital gains (a preferential rate compared to wage and salary income) and largely eliminating another (the ability to avoid capital gains tax completely by holding on to an asset until death).

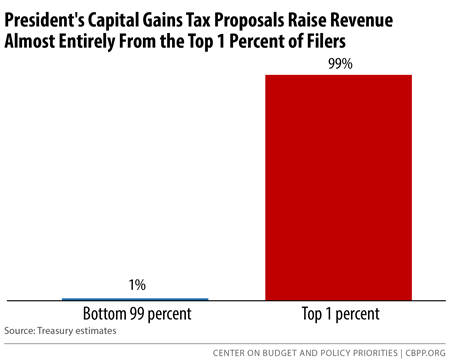

These changes would allow investments to flow to where they are most productive and reduce investment in creating tax avoidance schemes instead of in real economic activity, among other economic benefits. And, because the benefits of the current preferences for capital gains flow overwhelmingly to the top, fully 99 percent of the revenue from the President’s capital gains proposals would come from the top 1 percent of filers, the Treasury Department estimates [see graph]. . . .

We’ll be live-tweeting the State of the Union this evening. Follow along with @centeronbudget and at #cbppsotu.