BEYOND THE NUMBERS

The Washington Post’s Eugene Robinson quoted President Obama this week on the challenge of “helping young African American men feel that they’re a full part of this society and that they’ve got pathways and avenues to succeed.” While there’s no magic wand, one good place to start is with the Earned Income Tax Credit (EITC), which has proven to be a pro-work, bipartisan avenue of opportunity for millions of people, especially single mothers and even military families, as we’ve pointed out.

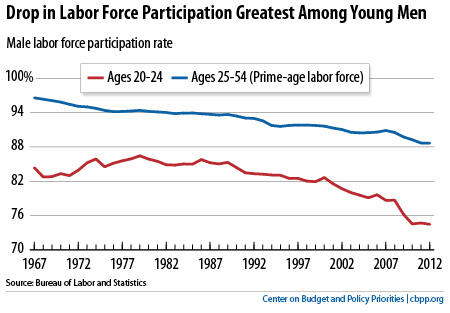

The EITC, which is our strongest pro-work success story, isn’t available to a group of young men who have among the hardest times getting started in the job market. Less-educated young people — particularly young African American men — face low and falling labor-force participation rates, low marriage rates, and high incarceration rates (see chart). The EITC could be a factor that helps them address these challenges — but it’s not an option right now, as we explain in our recent paper.

That’s because adults who aren’t raising minor children don’t qualify for the EITC until age 25. Policymakers didn’t want middle class kids in college to game the system when they developed the EITC for low-income workers who aren’t raising children, so they set the qualifying age above when many collegians have graduated. In addition, the EITC is very small for childless adults aged 25 and older, leaving this group with the sad distinction of being the only one that the federal government taxes into, or deeper into, poverty.

The EITC encourages employment by boosting the remuneration from work for people paid low wages. Extensive research has concluded that the EITC was at least as important as welfare reform in increasing employment among single women during the 1990s, and many economists believe that a stronger EITC for childless workers would have a similar effect for young men. In addition, some economists, such as the University of Wisconsin’s Karl Scholz, a leading expert on the EITC and related issues, believe that a more substantial EITC could reduce crime by making work in the above-ground economy pay more. Finally, by increasing employment experience when workers are young and encouraging a strong connection with the labor market, a more adequate credit for workers not raising children could improve these workers’ marriage prospects.

The good news is that there is some newfound momentum to open up this pathway to economic opportunity for low-income adults who aren’t raising children. Legislation has recently been introduced in the Senate by Sherrod Brown (D-OH) and Richard Durbin (D-IL) and 28 additional co-sponsors, including Sen. Max Baucus (D-MT), chairman of the Finance Committee and a chief tax reform negotiator. Parallel legislation has also been introduced in the House by Richard Neal (D-MA).

Support for this effort exists outside Congress, as well, with opinion leaders as ideologically diverse as Katrina vanden Heuvel, David Brooks, Ross Douthat, and Reihan Salam calling for an expanded EITC. The two bills before Congress offer an opportunity to lessen the barriers for these young men and give them a chance to get off to a better start as they move into adulthood.