BEYOND THE NUMBERS

A Wall Street Journal op-ed recycled some of the oft-repeated — and off-base — claims about how taxes affect a state’s economy.

In this piece yesterday, Arthur Laffer and Stephen Moore suggest that proposals in several states to cut personal income taxes would spur economic growth and entice individuals and companies to relocate. These points don’t stand up to scrutiny, as we’ve explained.

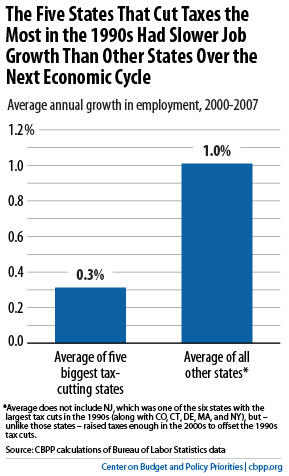

Recent history shows that deep income tax cuts don’t fuel growth. The five states that enacted the deepest tax cuts during the boom years of the middle and late 1990s saw job growth over the next full economic cycle (2000-2007) of less than 0.3 percent per year, on average, compared to 1.0 percent for the other states (see chart). They also had slower income growth than the rest of the nation on average.

Taxes aren’t a primary reason why people move. People mostly move from one state to another due to job prospects, housing costs, family considerations, and climate, our analysis found. Studies that take into account the wide range of other factors show consistently that taxes have little if any impact on migration.

The research refutes Laffer and Moore’s claims. Though Laffer and Moore claim that “all the empirical evidence shows that raising a state’s tax burden weakens its tax base,” eight major studies published in academic journals since 2000 have examined whether differences in state personal income tax levels affect states’ relative rates of economic growth. Six found no significant effects, and one of the others produced internally inconsistent results.

The evidence shows that the economics of these tax-cut proposals don’t add up. Nevertheless, states may still be tempted to take the risk, encouraged by faulty analysis of the type that Laffer and Moore promote. They shouldn’t do so. With their revenues still deeply damaged by the recession and their reserve funds depleted, states have little margin for error right now. A personal income tax cut would jeopardize funding for fundamental public services, including education, health care, and public safety. It would also lead to higher property or sales taxes, or both. (Personal income taxes account for 24 percent of state general revenues, on average.)

And with the federal government on track to impose deep cuts in funding for schools and other services that states provide, states have even more reason to protect their own revenue and, in turn, limit the damage to their public services.