BEYOND THE NUMBERS

Don’t Be Misled: Indiana’s Consumers Won’t Have to Pay $500 a Month for Health Insurance

Anyone who saw Indiana’s release of individual-market health insurance rates for 2014 might now have the misimpression that people there will have to pay an average of more than $500 per month in premiums to get coverage in the individual market in 2014.

But this figure, released by state officials who have been touting “rate shock” and bashing the health reform law, is highly misleading. It is not the average premium that consumers will actually have to pay. Here’s why:

The $536 average “base line rate” that Indiana’s Department of Insurance cited represents the average cost of providing covered benefits to people in the state’s individual market across several insurers. That includes how much the insurer pays and how much the individual will pay in out-of-pocket charges like deductibles and co-payments. In essence, the $536 figure is what insurers would spend on average to cover individual-market enrollees in Indiana if the insurers were responsible for all costs and enrollees paid nothing under their plans. But when figuring out the premium for a plan, the greater the enrollees’ share of costs, the lower the actual premium, and vice-versa. (The $536 figure also does not account for other important factors that affect premiums, including insurer profits, administrative costs, and risk mitigation programs under health reform.)

Filings submitted in Indiana by Anthem Inc. (currently the insurer with the biggest share of the state’s individual market) show an “index rate” (comparable to the Indiana Insurance Department’s “base line rate”) of $541 per member per month. A deeper look, however, shows how premiums would be calculated for an actual Anthem 2014 plan, which reveals more useful numbers. It shows that, for a 47-year-old non-smoker in Indiana’s Northwest corner, an Anthem bronze plan (a basic plan under the health law) would cost $307 per month without any federal premium subsidies. A 20-year-old non-smoker in that same geographic area would pay about $125 per month for the same plan.

Moreover, these premium figures do not reflect the tax credits that health reform provides to make coverage more affordable. Many people without health coverage as well as those already purchasing insurance in the individual market will qualify for assistance that will cap the maximum contribution they must make toward premiums at no more than a set percentage of their income.

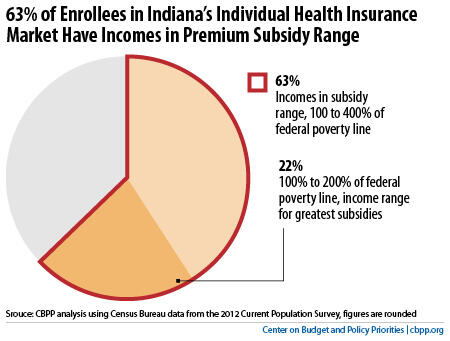

Of the 207,000 people who got coverage in Indiana’s individual insurance market in 2011, 63 percent were in the income range eligible for premium subsidies, according to a CBPP analysis of Census data. That includes 46,000 Indianans Hoosiers with incomes between the poverty level and two times the poverty level, where the federal subsidies are most generous (see chart). Among the far larger group of 764,000 Indianans Hoosiers who were uninsured in 2011, 30 percent had incomes between the poverty level and two times the poverty level, which would make them eligible for the most generous federal help with paying their premiums, and 56 percent overall have incomes in the subsidy range.

With just two months left before open enrollment starts for 2014, people who need affordable health insurance also need clear and accurate information about what coverage will actually cost — not anti-health reform rhetoric and arcane industry numbers that are easily misunderstood. Otherwise, consumers — for whom the health law holds tremendous benefits — may be deterred from enrolling.