BEYOND THE NUMBERS

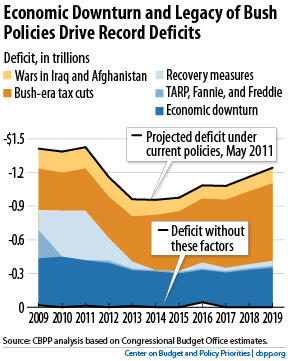

My colleagues Kathy Ruffing and Jim Horney have shown that the economic downturn, President Bush’s tax cuts, and the legacy of the wars in Iraq and Afghanistan explain virtually the entire federal budget deficit projected for the rest of this decade (that is, through 2019). That is, there would be practically no deficits over that period if the tax cuts, the wars, and the downturn had not occurred and other policies remained the same. This widely circulated CBPP chart makes their point vividly.

Over the 2002-2011 period, the negative budgetary impact of so-called “economic and technical” changes — most notably, the 2001 and 2007-2009 downturns — dwarfed that of any single legislative change that policymakers enacted. Samuelson cites an analysis of CBO data that accordingly ascribes about a quarter of the deterioration in the budget over that period to President Bush’s 2001 and 2003 tax cuts and the Iraq and Afghanistan wars.

The 2002-2011 period is now history. For the years ahead, CBPP found that the tax cuts (if policymakers extend them in full) and the wars, plus the lingering effects of the recent downturn, essentially account for the entire deficit between now and 2019. Indeed, the tax cuts and the wars alone account for nearly half of the public debt by 2019.

Samuelson pointed out that the policies that expanded deficits also raised interest costs. CBO lists this increase in interest payments as a separate item, and the figures Samuelson presented thus did so as well. Our analysis takes the logical next step; it illustrates more fully the deficit effect of various tax and spending policies by attributing to them not just their direct cost but the extra interest costs that they caused. (We also counted other tax reductions enacted on President Bush’s watch, such as the annual “patches” to the Alternative Minimum Tax to keep it from ensnaring millions of middle- and upper-middle-income households, as part of the Bush-era tax cuts’ cost.)

We can’t undo the mistakes of the last decade, but we can start to turn our budget picture around and prepare for the challenges of an aging population and rising health-care costs. Policymakers can take a big step by letting the tax cuts expire (the upper-income tax cuts now and the middle-income tax cuts when the economy has recovered more fully) or paying for any of the middle-class tax cuts that they propose to make permanent.