BEYOND THE NUMBERS

The Social Security Disability Insurance (DI) program provides modest but vital benefits to workers who become unable to perform substantial work on account of a serious medical impairment, as we explain in a new paper.

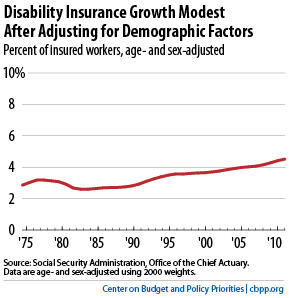

Although some critics charge that the program’s spending is “out of control,” in fact the bulk of the rise in federal disability rolls stems from demographic factors: the aging of the baby boom, the growth in women’s employment, and Social Security’s rising retirement age (see chart). Other factors — including the economic downturn — also have contributed to the program’s growth, but its costs and caseloads are generally in step with past projections.

The Social Security trustees project that the DI trust fund — which is legally separate from the Old Age and Survivors Insurance (OASI) trust fund for the Social Security retirement and survivors’ programs — will become insolvent in 2016; the Congressional Budget Office concurs. If policymakers don’t take action to bolster the fund, beneficiaries’ checks will have to be cut by about one-fifth after that. But the fund’s anticipated insolvency should come as no surprise; when policymakers last changed the allocation of taxes between DI and OASI in 1994, they expected the DI fund to run dry in 2016.

Policymakers should address DI’s pending depletion in the context of overall

. Both DI and OASI face fairly similar long-run shortfalls; DI simply requires action sooner. Key features of Social Security are similar or identical for the two programs, and most DI recipients are near or even over Social Security’s early-retirement age. Tackling DI in isolation would leave policymakers with few — and unduly harsh — options, and lead them to ignore the strong interactions between the disability and retirement programs. A balanced solvency package would also be an opportunity to make sorely needed improvements in the needs-tested Supplemental Security Income program, which is distinct from Social Security but has important intersections.If policymakers don’t agree in time on a sensible solvency package, however, they should reallocate taxes between the retirement and disability funds — a traditional and noncontroversial action that they’ve taken often in the past.

Click here to read the full paper.