BEYOND THE NUMBERS

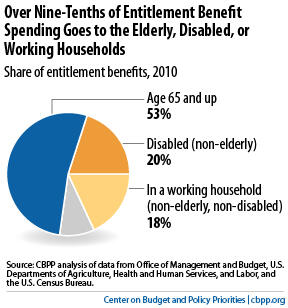

Contrary to claims that government benefit programs are creating a dependent class of Americans who are losing the desire to work and would rather collect government benefits than find a job, a major report we issued today finds that these programs’ benefits go overwhelmingly to people who are elderly, disabled, or members of working households.

As it states:

Some conservative critics of federal social programs, including leading presidential candidates, are sounding an alarm that the United States is rapidly becoming an “entitlement society” in which social programs are undermining the work ethic and creating a large class of Americans who prefer to depend on government benefits rather than work. A new CBPP analysis of budget and Census data, however, shows that more than 90 percent of the benefit dollars that entitlement and other mandatory programs spend go to assist people who are elderly, seriously disabled, or members of working households — not to able-bodied, working-age Americans who choose not to work. This figure has changed little in the past few years.

In a December 2011 op-ed, former Massachusetts Governor Mitt Romney warned ominously of the dangers that the nation faces from the encroachment of the “Entitlement Society,” predicting that in a few years, “we will have created a society that contains a sizable contingent of long-term jobless, dependent on government benefits for survival.” “Government dependency,” he wrote, “can only foster passivity and sloth.” Similarly, former senator Rick Santorum said that recent expansions in the “reach of government” and the spending behind them are “systematically destroying the work ethic.” . . .

Such beliefs are starkly at odds with the basic facts regarding social programs, the analysis finds.

Our analysis covers Social Security, Medicare, Medicaid, unemployment insurance, SNAP (formerly known as the Food Stamp Program), SSI, Temporary Assistance for Needy Families (TANF), the school lunch program, the Children’s Health Insurance Program (CHIP), the Earned Income Tax Credit, and the refundable component of the Child Tax Credit.

The only major entitlement programs that are not included are veterans’ programs and military and civil service retirement, which critics presumably do not have in mind when they warn of the dangers of the “entitlement society” in fomenting dependency and sloth. In any event, including these programs doesn’t change the above 91 percent figure.

The data dispel several other common misperceptions. For example:

- Contrary to claims that entitlements take heavily from the middle class to give to people at the bottom or shower benefits on the very wealthy, the middle 60 percent of the population receives close to 60 percent of the entitlement benefits, while the top 5 percent of the population receives about 3 percent of the benefits.

- Non-Hispanic whites receive slightly more than their proportionate share of entitlement benefits. They accounted for 64 percent of the population in 2010 and received 69 percent of the entitlement benefits.

Click here for the full report.