BEYOND THE NUMBERS

A number of states, including Arkansas, Kansas, Missouri, North Carolina, Ohio, and Wisconsin, are considering deep cuts in personal income taxes to spur economic growth. But both recent history and empirical studies suggest that this approach doesn’t work particularly well, as our new report explains.

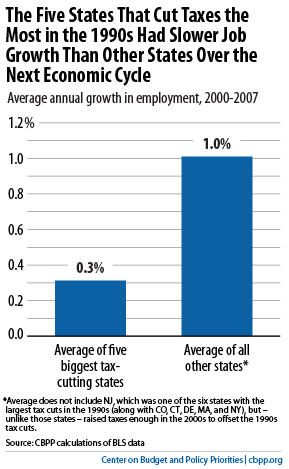

First, let’s look at recent history. Of the six states that cut income taxes sharply between 2000 2002* and 2007 (when the recession hit), three grew more slowly than the rest of the country in the years that followed. The other three saw above-average growth, but they are major oil-producing states (Louisiana, New Mexico, and Oklahoma) that benefitted from a sharp rise in oil prices.

As for empirical studies, eight major studies published in academic journals since 2000 have examined whether differences in state personal income tax levels affect states’ relative rates of economic growth. Six found no significant effects, and one of the others produced internally inconsistent results.

Despite the evidence that cutting personal income taxes does little to boost state economies, states may still be tempted to take the risk. That would be a mistake.

With their revenues still deeply damaged by the recession and their reserve funds depleted, states have little margin for error right now. Gambling on a personal income tax cut would put fundamental public services, which in most states are heavily dependent on personal income tax revenue, at risk. (Personal income taxes account for 24 percent of state general revenues, on average.)

And with the federal government on track to impose deep cuts in funding for schools and other services that states provide, states have even more reason to protect their own revenue in order to limit the damage to their public services.

*Correction, March 25: we changed 2000 to 2002 in the second paragraph.