BEYOND THE NUMBERS

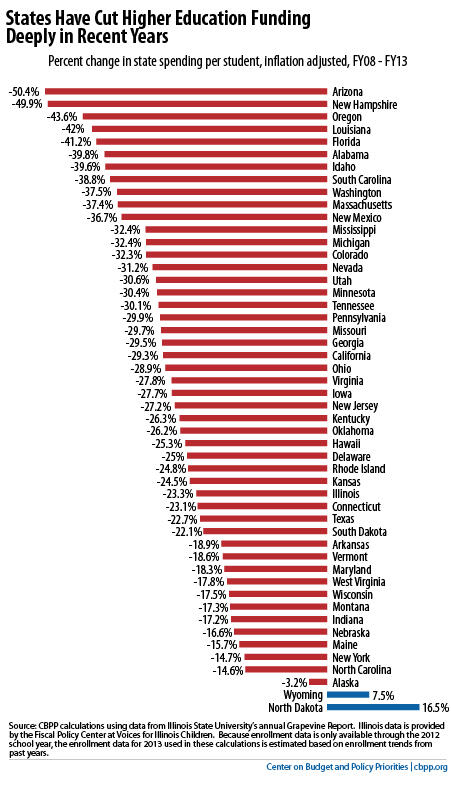

State cuts to higher education funding in the last five years have been severe and almost universal, as we explain in a new paper. After adjusting for inflation:

- States are spending $2,353 or 28 percent less per student on higher education, nationwide, in the current 2013 fiscal year than they did in 2008, when the recession hit.

- Every state except for North Dakota and Wyoming is spending less per student on higher education than they did before the recession.

- Eleven states have cut funding by more than one-third per student, and two states — Arizona and New Hampshire — have cut their higher education spending per student in half (see chart).

Deep state funding cuts have major implications for public colleges and universities. States (and to a lesser extent localities) provide 53 percent of the revenue that is used to support instruction at these schools. When this funding is cut, colleges and universities generally must either cut spending, raise tuition to cover the gap, or both.

That’s just what they’ve done. Over the last five years, public colleges and universities have both steeply increased tuition and pared back spending, often in ways that compromise the quality of the education that they offer.

Reversing these trends and reinvesting in higher education should be a high priority for state policymakers. A large and growing share of future jobs will require college-educated workers. Investing in higher education to keep tuition low and quality high at public colleges and universities, and to provide financial aid to students who need it most, would help states to develop the skilled workforce they will need to compete for these jobs.

But to strengthen state investment in higher education, state policymakers will need to make the right tax and budget choices over the coming years. The weak economic recovery and the need to reinvest in other services that also have been cut deeply means that many states will need to raise revenue to rebuild their higher education systems. At the very least, states must avoid shortsighted tax cuts, which would make it much harder for them to invest in higher education, strengthen the skills of their workforce, and compete for the jobs of the future.

Click here to read the full paper.