BEYOND THE NUMBERS

One of the largest tax cuts any state has ever enacted took effect in Kansas at the beginning of last year. The state sharply reduced its income tax rates and fully exempted certain business profits from taxation. It also adopted a plan to cut income tax rates even further over the next few years.

Now, in a number of other states, proponents of tax cuts are saying that Kansas’ approach is a model for how to grow a state’s economy. As we explain in our new paper, Kansas is anything but. In fact, it’s a cautionary tale for five major reasons.

- Deep income tax cuts caused large revenue losses. Kansas’ tax cuts this year are costing the state about 8 percent of the revenue it uses to fund schools, health care, and other public services, a hit comparable to a mid-sized recession. State data show that the revenue loss will rise to 16 percent in five years if the state does not reverse the tax cuts.

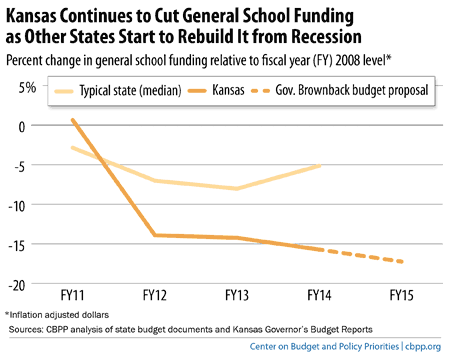

- The revenue losses extended and deepened the recession’s damage to schools and other state services. Most states are restoring funding for schools after years of significant cuts, but in Kansas the cuts continue (see chart). Governor Sam Brownback recently proposed another reduction in per-pupil general school aid for next year, which would leave funding 17 percent below pre-recession levels. Funding for other services — colleges and universities, libraries, and local health departments, among others — also is way down, and falling.

Image

- The tax cuts delivered lopsided benefits to the wealthy. Kansas’ tax cuts didn’t benefit everyone. Most of the benefits went to high-income households. Kansas even raised taxes for low-income families to offset part of the revenue loss; otherwise the cuts to schools and other services would have been greater still.

- Kansas’ tax cuts haven’t boosted its economy. Since the tax cuts took effect at the beginning of 2013, Kansas has added jobs at a pace modestly slower than the country as a whole. Average earnings fell more in Kansas in the year after the tax cut than in the rest of the country over the same period, while non-farm personal incomes rose less in Kansas than the nation as a whole. And so far there’s no evidence that Kansas is enjoying exceptional business growth: the number of registered businesses grew more slowly last year than in 2012, and the state’s share of all U.S. business establishments fell over the first three quarters of last year, which is the latest data available.

- There’s little evidence to suggest that Kansas’ tax cuts will improve its economy in the future. No one knows for certain how Kansas’ economy will perform in the years ahead, but it isn’t likely to stand out from other states. The latest official state revenue forecast, from November 2013, projects Kansas personal income will grow more slowly than total national personal income in 2014 and 2015.

Kansas’ tax cuts have meant big revenue losses and continued cuts in schools, colleges, and other services, with no noticeable economic gains. That’s not a recipe that other states should want to follow.

Click here to read the full paper.