BEYOND THE NUMBERS

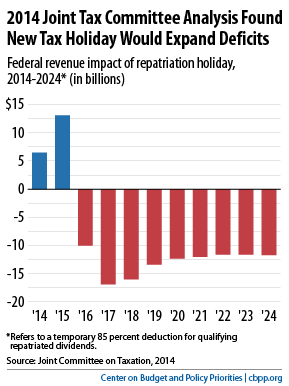

Explaining why the “repatriation tax holiday” proposal from Senators Rand Paul (R-KY) and Barbara Boxer (D-CA) actually would lose revenues (so it couldn’t pay for highway construction as they claim), we cited a 2014 Joint Committee on Taxation (JCT) analysis showing that a new holiday would expand deficits. The Paul-Boxer holiday is designed to push more of its revenue losses outside the ten-year budget window, thereby hiding the true long-term cost. But, like any repatriation holiday, it would bleed revenues for decades.

A new repatriation holiday (following the one that policymakers enacted in 2004) would allow U.S.-based multinational corporations to bring profits they hold overseas back to the United States at a temporary, vastly reduced tax rate. It would boost revenues during the holiday period, as companies rushed to take advantage of the temporary low rate. But it would lose revenues thereafter. As JCT explained, the biggest reason is that a second holiday would encourage companies to shift more profits and investments overseas in anticipation of more tax holidays, thus avoiding taxes in the meantime.

JCT’s analysis of a two-year holiday featuring a 5.25 percent rate on overseas profits clearly shows how it would lose revenues after the holiday years (see graph).

The Paul-Boxer plan gives firms five years to take advantage of its holiday rate of 6.5 percent, so its costs likely wouldn’t begin showing up until the sixth year. As a result, over the initial decade it could be less expensive or even appear to be revenue-neutral or raise money, but it would still cost money over the long run. By delaying the federal costs, spreading out the holiday could function as a timing gimmick. Policymakers who pretend to use the holiday to “pay for” highways or anything else would only add to long-term deficits.

The Paul-Boxer plan shouldn’t be confused with the President’s proposed mandatory transition tax on offshore profits to pay for infrastructure. Unlike a repatriation holiday, a well-designed transition tax would raise real revenues and is a sound way to deal with multinationals’ vast pile of offshore profits.